Constructing adaptable and personalized Uniswap-like DEX platforms that enable peer-to-peer trades and do away with go-betweens. We will integrate distributed shared order books and APIs for connecting to other exchanges, liquidity pools, and automated market-making (AMM) systems.

DeFi Applications Development Services

What is DeFi?

Decentralized Finance, or DeFi, is a revolutionary approach to financial services that leverages blockchain technology and smart contracts to create transparent, trustless, and permissionless financial ecosystems. By eliminating intermediaries and enabling peer-to-peer transactions, DeFi opens up new businesses opportunities to offer innovative financial products and services, reduce costs, and reach a wider audience.

From lending and borrowing platforms to decentralized exchanges and insurance protocols, DeFi has the potential to disrupt traditional finance and create a more inclusive, efficient, and resilient financial system.

DeFi Development Services We Provide

Decentralized finance (DeFi) development opens up the realm of finance from a drastically new point of view, enabling numerous mechanics and opening up new ways to see finance. See what opportunities can Devox leverage for you.

-

Decentralized Exchange (DEX) Development

-

DeFi Protocol Development

Developing underlying protocols that serve as the foundational building blocks for DeFi projects. These might include protocols for specific functions like lending, insurance, asset management, etc.

-

DeFi Smart Contract Development

Blockchain consists of smart contracts, the algorithms that create and provide data on digital assets, which they use to link your ideas with their technical fulfillment. We code, test, and deploy smart contracts that automate transactions and enforce the terms of agreements on the blockchain.

-

Cryptowallet Development

Creating Web3-based digital wallets that handle and hold the local money of the platform and act as a key to access Web3 dApps on multiple blockchains. Be sure to get a multifunctional, convenient, and compliant wallet, offering your users a safe and efficient way to manage and transact their digital assets.

-

Tokenization and Token Development

The tech professionals at Devox can assist you with tokenizing any physical asset (including real estate, securities, and collectibles), streamlining its administration, and opening it up for investment. We implement custom tokens using standards like ERC-20 for Ethereum that represent various financial instruments and are used within DeFi ecosystems for transactions, governance, or incentive structures.

-

Stablecoin Development

Stablecoins are cryptocurrencies pegged to a specific asset in their value, typically a fiat currency like the US dollar, to reduce volatility and provide a reliable medium of exchange. Get a cryptocurrency that combines the benefits of digital currency with the stability of traditional assets, reducing volatility in transactions thanks to Devox’s expertise.

-

Yield Farming and Liquidity Mining

We develop platforms that enable users to engage in yield farming or liquidity mining, earning rewards by providing liquidity or staking assets. Clients can attract a robust user base by offering competitive returns and fostering a sustainable liquidity environment.

-

DeFi Lending and Borrowing Platform Development

We build decentralized platforms that facilitate peer-to-peer lending and borrowing, secured by smart contracts. Clients provide their users with flexible, secure lending services, enhancing capital accessibility without the need for a traditional financial intermediary.

-

Staking Platform Development

Let your users participate in the network’s security and governance by locking up their digital assets, shaping the backbone of your blockchain. We will develop a proof-of-stake consensus mechanism where users can stake their tokens to support network operations and security in exchange for rewards, manage their staked assets, view their earning potential, and make informed investment decisions.

-

Cross-chain Bridges and Interoperability Solutions

We create solutions that enable asset and data interoperability across different blockchain networks. You will enhance their capability to interact and transact with one another, thereby broadening the reach and functionality of your DeFi applications. Benefit from expanded market reach and enhanced functionality as your infrastructure interacts with multiple blockchains.

Benefits of Custom DeFi Applications Development

The promise of DeFi development services is about getting together blockchain-caused shift in finance and applications longed for in this sphere. You will enhance a lot of metrics, such as:

-

Decentralization

Eliminate your dependency on middlemen along with manual labor-dictated delays and operational costs of these processes. DeFi erases the need for centralized financial intermediaries like banks, brokers, and exchanges. This reduces the points of failure and potential control by a single entity, distributing power and decision-making across a wider network of users.

-

Accessibility

Remove barriers to entry for banking and financial services anywhere you wish to see your clients, particularly in underserved or unbanked regions, providing equal access to financial tools to a huge audience previously excluded. You will remove not just geographical barriers to entry that are common in traditional finance, but also minimum balance requirements, or credit history checks.

-

Complete Automation and Lightning Speed

Thanks to decentralization, your business will take advantage of unconditional automation and the lack of human factors where it’s most needed. Blockchain’s transaction speed is momentary regardless of the transfer’s destination in contrast to several banking days.

-

Transparency and Compliance

DeFi has the potential to comply with most jurisdictions’ regulations thanks to its transparent processes and automated operations. Since it operates on blockchain, all transactions are transparent and publicly verifiable. This openness increases trust among users as it allows for easy auditing of financial activities by anyone in the network.

-

Technology Providing Flexibility

Many DeFi products are built on compatible blockchain platforms like Ethereum, facilitating seamless interactions between different applications and services. This interoperability fosters a rich ecosystem where users can easily move assets across different DeFi services. Moreover, the high programmability of smart contracts lets developers create sophisticated and automated financial services that can react to market conditions in real-time.

-

Innovation in Financial Products

Enjoy the freedom to create novel financial products and services that are not feasible in traditional finance. This includes complex strategies for trading, lending, borrowing, and risk management, often automated by smart contracts. It’s also about various mechanisms to earn interest or rewards through activities like staking, liquidity mining, and yield farming, often with higher returns than traditional banking.

-

Improved Security

Blockchain provides security features like cryptographic encryption and consensus algorithms that protect transactions and data. With the automation smart contracts provide, lowering the risk of errors and manipulation comes automatically - thanks to system resilience and eliminating the human factor. Additionally, blockchain's decentralized nature ensures no single point of failure, making DeFi systems more resilient against attacks and fraud.

-

Reduced Costs

By eliminating intermediaries and automating financial processes with smart contracts, DeFi significantly reduces the fees associated with transactions and financial services. Traditional financial systems involve various intermediaries who each take a cut, increasing overall costs. DeFi platforms, by contrast, typically have lower overhead costs and can pass these savings on to users in the form of lower fees and higher returns on investments.

-

Ownership and Control

Grant your users complete control over their financial assets. Unlike traditional banking systems, where banks can freeze accounts or deny transactions, DeFi platforms allow users to manage their funds in a permissionless environment using secure digital wallets. This level of control not only enhances user autonomy but also improves access to financial services across the board.

Key Features of DeFi Applications

Blockchain

The foundational layer where all DeFi applications are built. Blockchains like Ethereum provide a secure, immutable, and decentralized infrastructure necessary for running DeFi applications. The blockchain records all transactions and ensures they are tamper-proof.

Smart Contracts

These are self-executing contracts with the terms of the agreement directly written into code. Smart contracts automate and enforce the performance of agreements without human intervention, serving as the backbone for most DeFi operations such as lending, borrowing, trading, and liquidity provision.

Tokens

Most DeFi applications use tokens, which can represent a variety of assets or rights within the ecosystem. These include governance tokens, utility tokens, or asset-backed tokens like stablecoins. Tokens are integral for facilitating transactions, providing incentives, and enabling governance within DeFi protocols.

Consensus Mechanisms

DeFi applications rely on blockchain consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS) to validate transactions and maintain network security. These mechanisms help ensure that all participants agree on the current state of the ledger without needing a central authority.

Oracles

Since blockchains and their smart contracts can't access real-world data directly, oracles are used as data feeds that bring external information into the blockchain. Oracles are crucial for many DeFi applications that rely on real-time information, such as price feeds for asset trading or interest rates for lending platforms.

Decentralized Exchanges (DEXs)

These platforms allow for the peer-to-peer trading of cryptocurrencies without a central authority. They use liquidity pools and algorithms like Automated Market Makers (AMMs) to facilitate trading directly on the blockchain.

Wallets

DeFi wallets enable users to interact with DeFi applications by storing their private keys and facilitating transactions. Wallets must be secure and compatible with the specific blockchains and standards used by DeFi protocols.

Liquidity Pools

These are pools of tokens locked in a smart contract that provide liquidity for trading pairs on decentralized exchanges. Users, often called liquidity providers, contribute an equal value of two tokens in a pool to facilitate trading and earn transaction fees or other rewards in return.

Governance Protocols

Many DeFi projects incorporate decentralized governance, allowing token holders to propose, vote on, and implement changes to the protocol. This democratic approach helps ensure that the project evolves in a way that benefits all stakeholders.

Industry Contribution Awards & Certifications

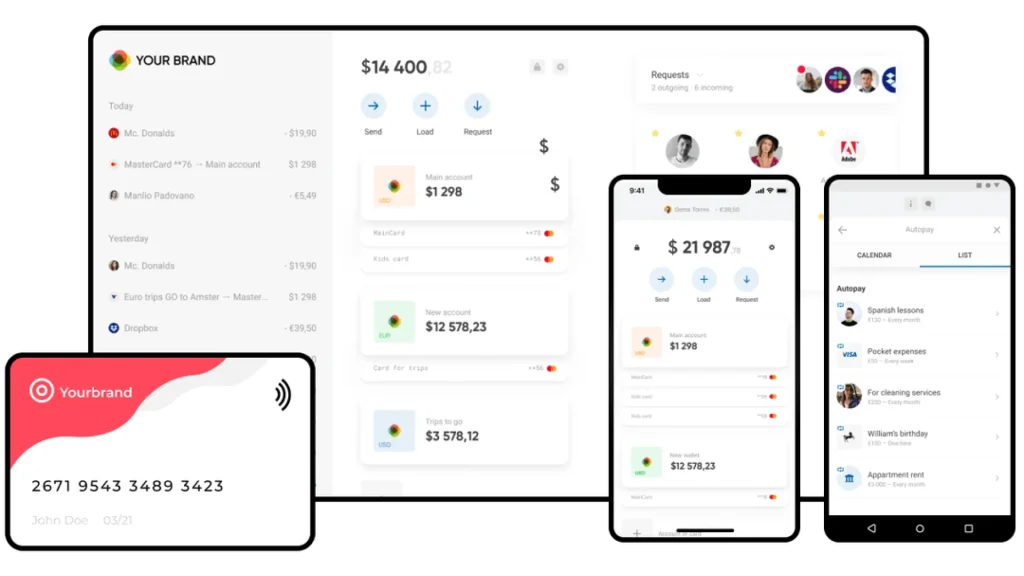

Web3 PaaS Ecosystem for Next-Gen NeoBanking, RegTech, and Secure Data Vaulting

A blockchain-powered PaaS ecosystem enabling financial providers to launch custom neobanking solutions with secure infrastructure.

Additional Info

- Blockchain

- .NET

- Node.js

- AWS

- Docker

- PostgreSQL

- React Native

USA

Testimonials

FAQ

-

What is the difference between DeFi and traditional finance?

DeFi, or decentralized finance, leverages blockchain technology and smart contracts to create finance systems that are open, borderless, and operate without central authorities or intermediaries. This contrasts with traditional finance, which is characterized by its reliance on banks, institutions, and government regulations to facilitate transactions, manage accounts, and issue credit. The fundamental difference lies in DeFi’s ability to democratize access to financial services, ensuring greater transparency, and potentially lower costs for users, while traditional finance systems are more established but often come with higher fees and geographic or bureaucratic barriers to access.

-

Is DeFi safe?

Like any evolving technology, DeFi carries its own set of risks and vulnerabilities, including smart contract bugs, protocol failures, and market volatility. However, the DeFi ecosystem is continuously improving, with robust security practices such as regular audits, bug bounty programs, and community review of code becoming standard. Users can enhance their safety by staying informed, using secure wallets, and interacting only with reputable protocols. While DeFi opens up new avenues for financial innovation and freedom, it also requires a level of responsibility and diligence from its users.

-

What blockchain networks do you support for DeFi development?

While our primary focus is on popular networks like Ethereum, Binance Smart Chain, and Polygon due to their widespread adoption and developer-friendly environments, our expertise extends across various EVM (Ethereum Virtual Machine)-compatible chains such as Avalanche, Fantom, and others. We choose blockchain platforms based on factors like transaction speed, cost, and network security, ensuring that your DeFi application aligns with the best technology available to meet your project’s needs and goals. Our flexible approach allows us to adapt to emerging technologies and chain innovations, providing you with a future-proof DeFi solution.

-

How long does it take to develop a custom DeFi application?

The development timeline of a custom DeFi application can range significantly based on several factors, including the complexity of the application, the features required, and the level of customization needed. A basic DeFi application with standard functionalities such as swapping or liquidity provision might take 3-6 months, while more complex projects involving novel financial instruments or intricate smart contracts could extend beyond that timeframe. Our development process is thorough, starting with a detailed analysis of your requirements, followed by meticulous planning, design, development, and rigorous testing phases to ensure the final product is not only launched smoothly but also meets our high standards of quality and performance.

-

What are the key advantages of using DeFi over traditional financial systems?

DeFi blockchain development eliminates the need for central financial intermediaries such as banks, brokers, and clearinghouses. This not only speeds up transactions but also reduces costs associated with fees. Unlike traditional systems, DeFi offers transparency as every transaction is recorded on a blockchain, visible and auditable by anyone. Furthermore, DeFi operates on a global scale, providing unrestricted access to financial services 24/7. This is particularly beneficial in emerging markets where traditional banking infrastructure is limited or non-existent.

-

Can DeFi applications integrate with existing financial systems?

Yes, DeFi app development can be designed to integrate with existing financial systems, enhancing their functionality and user base. Through APIs and the development of interoperable platforms, DeFi apps can interact with traditional financial infrastructures, allowing for seamless transfer of assets between decentralized and centralized systems. This integration can facilitate easier onboarding of traditional investors into DeFi markets, provide enhanced services like cross-platform asset management, and even enable compliance with regulatory frameworks, bridging the gap between new blockchain technologies and established financial operations.

Want to Achieve Your Goals? Book Your Call Now!

We Fix, Transform, and Skyrocket Your Software.

Tell us where your system needs help — we’ll show you how to move forward with clarity and speed. From architecture to launch — we’re your engineering partner.

Book your free consultation. We’ll help you move faster, and smarter.

Let's Discuss Your Project!

Share the details of your project – like scope or business challenges. Our team will carefully study them and then we’ll figure out the next move together.

Thank You for Contacting Us!

We appreciate you reaching out. Your message has been received, and a member of our team will get back to you within 24 hours.

In the meantime, feel free to follow our social.

Thank You for Subscribing!

Welcome to the Devox Software community! We're excited to have you on board. You'll now receive the latest industry insights, company news, and exclusive updates straight to your inbox.