We developed a product as a platform-as-a-service application, meaning that it provides a platform and environment for developers to build, deploy, and manage financial services and applications. It consists of 3 main components, each of which is a self-sufficient software-as-a-service.

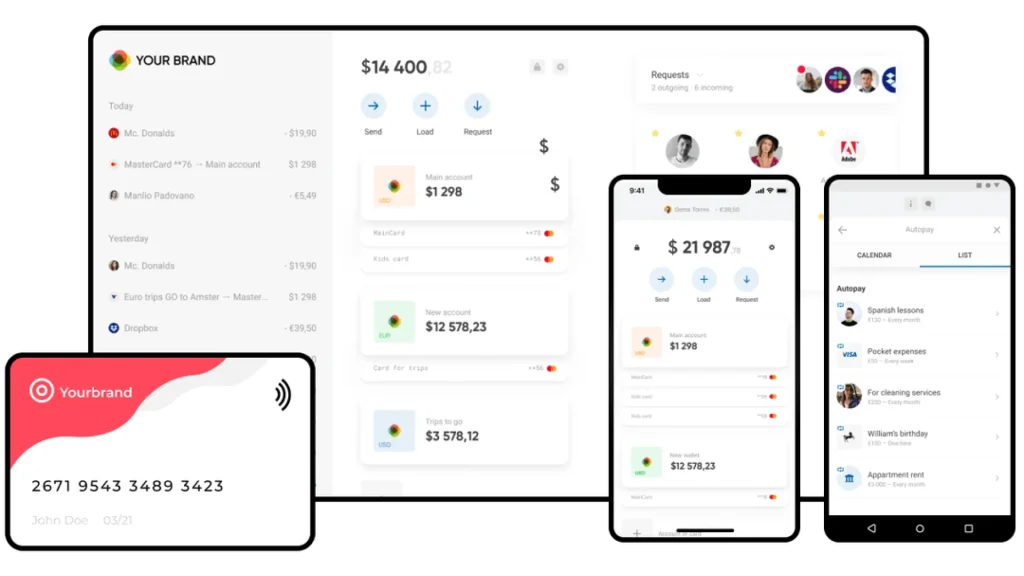

Neobank

The first idea client had in mind was a neobank as a white-label SaaS system for building a banking application. We helped design such an application with the server side built on the custom blockchain, uniting AI and smart contracts. It enables banks to build mobile apps under their brand from scratch, making use of already existing processes and design frameworks. The solution’s value lies in offering 3rd party licenses, permissions, certifications, and modular microservices for legitimate use.

A white-label digital banking application for Web, iOS, and Android supports IBAN/ACH account issuance, SEPA and SWIFT transfers, branded prepaid card issuance, mobile payments, and KYC/AML compliance, among other features.

Support of various internal and domestic payments and payment systems

- Sending and requesting payments from friends or contacts in one click.

- Any-Card-to-Any-Card transfers: send money from your card to any other card by just pasting the card number.

- Apple Pay and Google Pay payments integration available.

- Digital receipts: view your transactions and spendings right in your card history.

Card & Account Issuance

Send, request and load your banking information easily right from the app.

Multicurrency ACH bank account. Create a multicurrency account and exchange currency within the app.

Virtual and plastic multicurrency debit card. Hold your money in various currencies in several crds at once.

Domestic and international transfers. Send money within your country or with IBAN credentials.

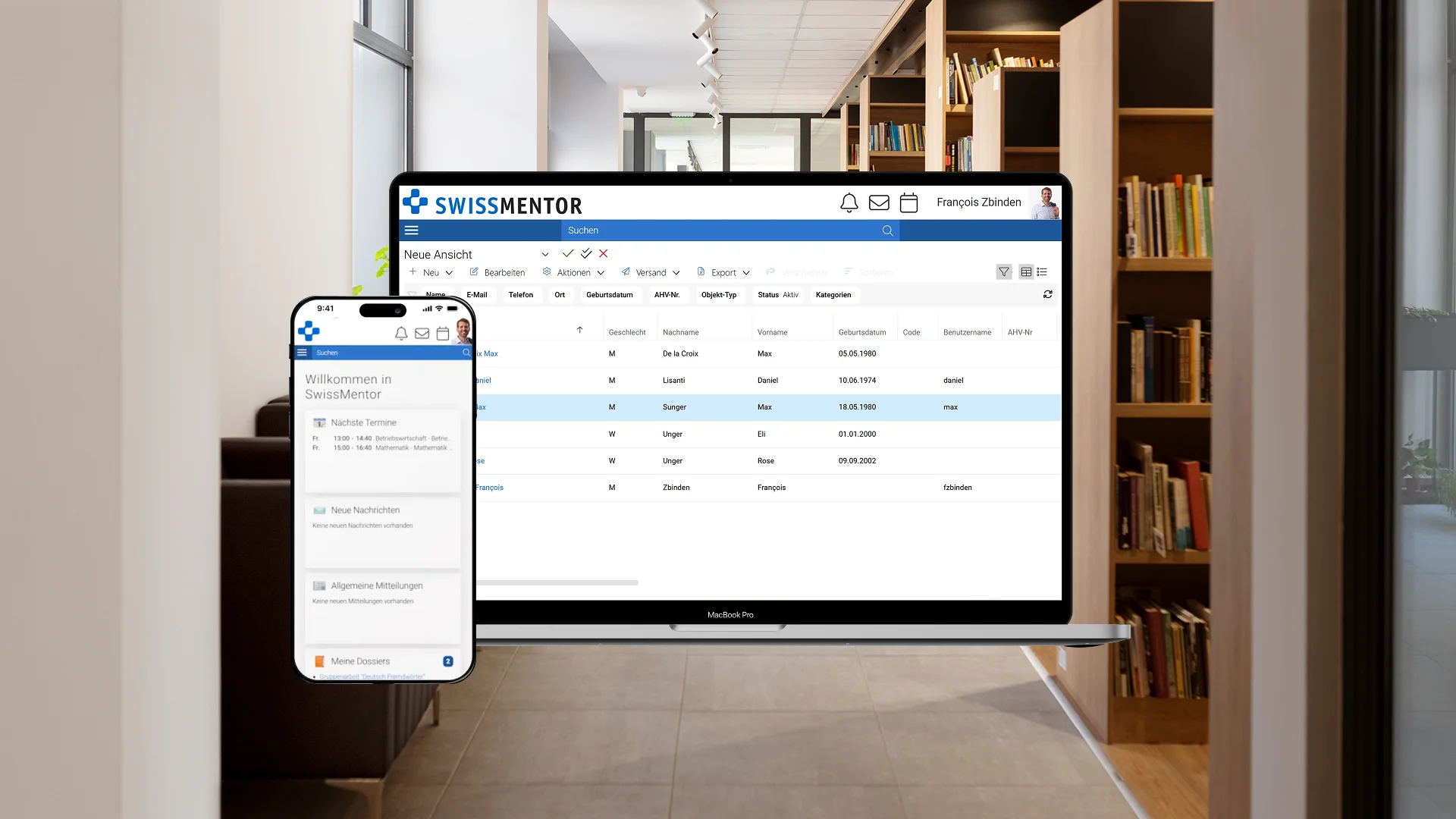

DataVault

DataVault Storage is a secure blockchain-based environment developed for storing sensitive data and digital assets. We developed this product primarily to cover the needs of big enterprises, banks, governments, fintech solutions and Fortune 500 enterprises. Its key value lies in helping communicate and manage sensitive data and digital assets in a permission-based, fraudless, and unhackable environment.

The DataVault Storage SaaS serves as a private blockchain operating system (OS) designed for enterprises, offering an exceptionally secure environment for data management. It is built upon patented Multi-decentralization technology, delivering military-grade security and mitigating data loss risks for organizations. We made the solution fully GDPR-compliant so that it only gives out KYC-based permissions to users. It involves cloud and on-premise storage, software development kit and API, and network management tools.

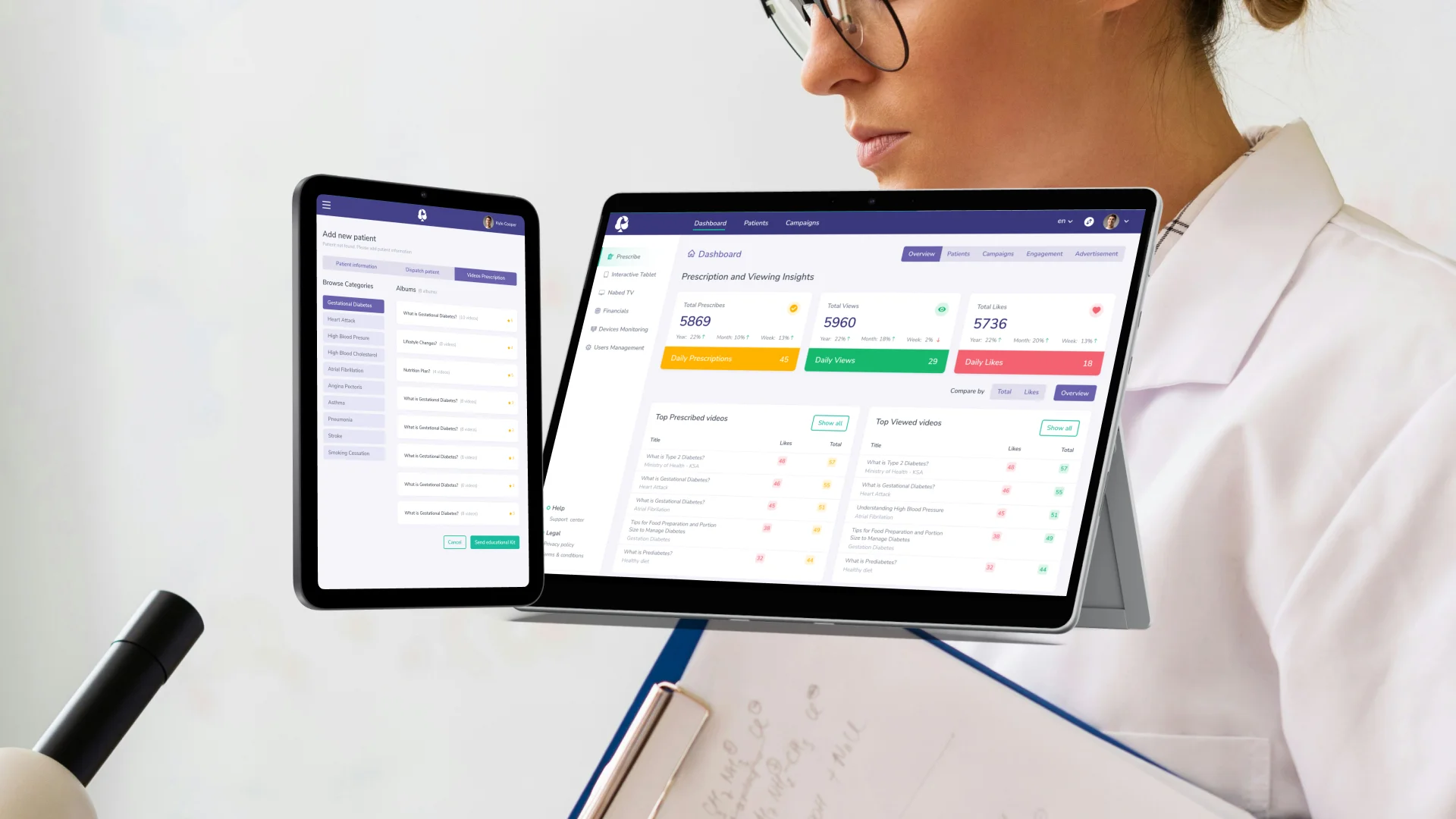

Regtech

Regtech is a platform for user verification and full-scale know-your-client procedure. It helps businesses conduct the KYC procedure effortlessly by automating processes and incorporating a range of convenient features.

Mobile and web KYC onboarding

We thought out the KYC process both for the business and the user side from web and mobile perspectives. Our objective was to enable the end user to pass the procedure in the most fast and convenient way possible without sacrificing any regulatory compliance.

Batch processing

This software empowers the capability to conduct batch checks, verifying the identities of millions of users within minutes. It accomplishes this through both manual and automated scheduled AML/global watchlist checks, which can be performed on a daily, weekly, or monthly basis.

Global watchlist screening

We incorporated the tools to provide global watchlist screening. This feature helps fintechs, banks, and large enterprises achieve regulatory compliance.

Transaction monitoring

The transaction monitoring module serves as an exceptional tool for continuous AML compliance, detecting suspicious activities, and preventing fraud. It offers a predefined library of transaction monitoring rules, which can be easily tailored to suit specific needs, enabling businesses to automate operations and reduce administrative expenses.

KYB onboarding

The “Know Your Business” module enables businesses to conduct immediate enhanced due diligence and complete online onboarding of corporate clients while maintaining full regulatory compliance.

Dynamic biometrics

The Dynamic Biometrics module empowers users to utilize biometric data, including facial (both video and photo) and voice recognition, for purposes such as verification, authentication, and compliance with PSD2 regulations within the mobile banking platform.

Credit risk scoring

An automated credit risk scoring tool designed for banks and fintech companies, leveraging machine learning and customizable mobile and web interfaces, enables businesses to remotely assess and make loan decisions for clients.

RFID chip

Mobile verification of biometric passports and RFID chips using a phone’s NFC scanner empowers businesses to combat identity fraud, improve security and user experience, and attain regulatory compliance.