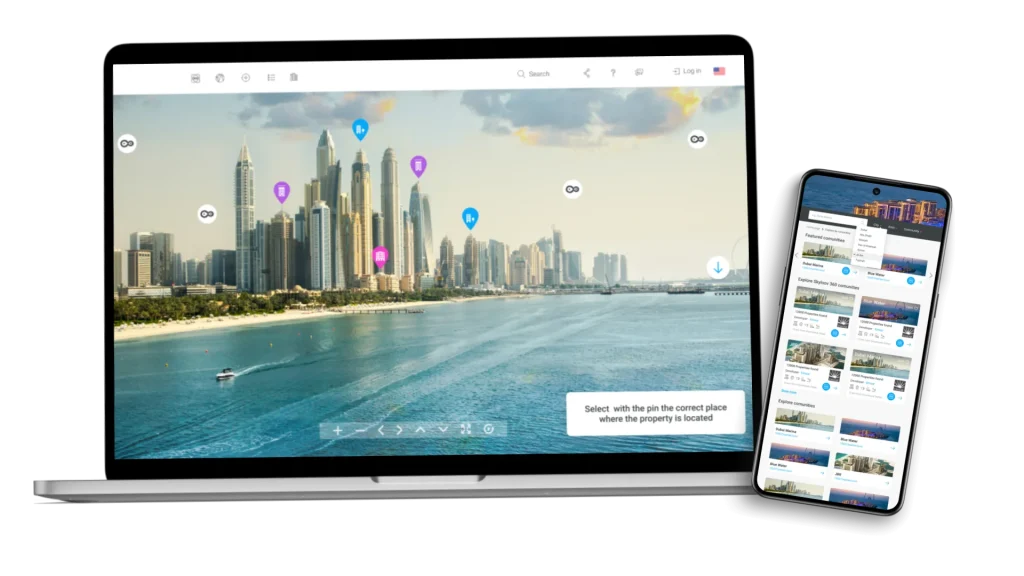

We can assist you in developing loan origination software that is used to create a new loan agreement between a lender and a borrower. Loan origination software development helps automate and streamline the loan origination process, customizing it to meet the specific needs of different lenders and borrowers, depending on various factors such as the type of loan, the lending criteria, and the regulatory requirements.

- Application Processing

- Credit Assessment

- Underwriting

- Document Preparation

- Funding