Leveraging AI to enhance blockchain applications, including smart contracts for automated compliance, fraud detection in cryptocurrency transactions, and optimizing decentralized finance (DeFi) operations. Monitor blockchain transactions, analyzing cryptocurrency market trends and enhancing security in digital currency exchanges.

AI Solutions for FinTech Development

AI Solutions for FinTech Services We Provide

AI solutions for finance encompass a broad range of functions, offering solutions for clients and for your internal infrastructure. See what Devox can make for you.

-

Blockchain and Smart Contract Integration

-

Financial Forecasts and Wealth Management

Empower your clients with precise market insights and personalized wealth management strategies: the Devox-made solution will analyze market trends, predict financial outcomes, and provide tailored investment advice, ensuring clients can make informed decisions and maximize their financial growth. Open up access to a comprehensive wealth management solution that automates portfolio management, optimizes asset allocation, and enhances risk assessment.

-

Personalized Banking and Financial Advice

AI-driven chatbots and robo-advisors offer personalized financial advice and customer service, helping users manage their finances, investments, and savings plans more efficiently.

-

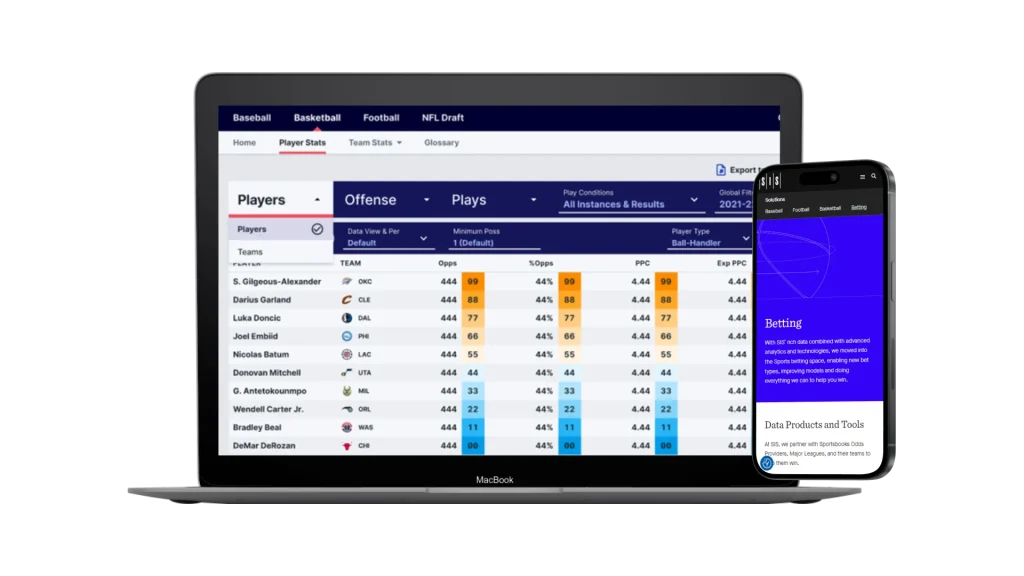

Data Analytics and Visualization Services

Unlock insights into financial data through advanced analytics and visualization tools that will help you make informed decisions, identify trends, and uncover investment opportunities. Devox incorporates machine learning models to analyze large datasets for insights, predict trends, and automate decision-making processes, particularly in investment, trading, and risk assessment.

-

NLP Solutions

Let us develop a natural language processing solution of different complexity and purpose. We can make conversational chatbots and virtual assistants handling customer service, providing financial advice, and facilitating transactions to make your client happier. Our expertise also covers more complicated NLP models that can analyze human language from various sources, such as customer support tickets, social media, and financial documents, for sentiment analysis, customer service automation, and regulatory compliance.

-

Fraud Prevention and Detection

Reduce financial losses and take your customer trust to the next level: Devox can create sophisticated models that analyze transaction patterns in real time to identify, flag, and prevent fraudulent activities, thereby safeguarding assets and enhancing trust. Gain peace of mind while maintaining a strong reputation in a risk-prone financial environment.

-

Regulatory Compliance (RegTech)

Navigate complex regulatory landscapes easily, reducing the risk of non-compliance penalties while saving on operational costs. Devox will develop tools that streamline the compliance process by automatically monitoring transactions and flagging those that could potentially violate regulations. Reduce the risk of fines and legal issues while raising the bar of transparency.

-

Credit Scoring and Underwriting Automation

Developing models that use alternative data sources and AI to offer more accurate and inclusive credit scoring and underwriting processes, improving access to financial services. Revolutionize lending processes for your clients with a streamlined procedure and more personalized loan products with reduced default risks.

Benefits of AI Solutions for FinTech Services

Examples of AI in financial services demonstrate this technology’s potential to boost security, reduce risks, and generally promote financial awareness among users. How exactly can you benefit from developing and implementing a custom solution?

-

Become Reacher Along with Your Client

Personalize banking experience in new ways. Provide your clients with the investment and trading insights AI algorithms analyze via chatbots, virtual assistants, or personalized financial advice with optimized trading strategies, letting them manage their portfolios more effectively. You will significantly improve not just their satisfaction and engagement but also promote their financial gainings.

-

Ensure Full Compliance Easily

Streamline compliance processes by automatically monitoring and analyzing transactions for any potential violations, thus reducing the risk of penalties: with the help of AI-driven development, you’ll also tackle constantly changing financial regulations, minimizing the probability of legal issues and automating the reporting process.

-

Advance Risk Management

Tailor your risk management strategies, reduce defaults, and optimize your financial portfolios. Through predictive analytics and machine learning models, your financial service AI software will improve risk assessment in credit scoring, investments, and insurance underwriting, leading to more informed and strategic decisions.

-

Efficient Data Processing and Analysis

Have vast amounts of data processed at high speeds, salvaging valuable insights, predicting trends, and enabling data-driven decision-making. The big data fintech solution by Devox will extract information from any unstructured data thanks to ML and NLP technologies to detect trends, generate forecasts, and provide actionable intelligence.

-

Enhanced Security and Fraud Detection

By analyzing transaction patterns and behaviors in real-time, AI can identify and prevent fraudulent activities more accurately, doubling down with biometric verification and behavioral analytics. You will detect and prevent unauthorized access to accounts, reducing financial losses and increasing trust among users on the way.

Key Features of AI Solutions for FinTech

Advanced Data Analytics

AI in the financial industry processes and analyzes vast amounts of data from various sources, including transactions, customer interactions, and market trends. This capability allows for deep insights into customer behavior, risk assessment, and financial forecasting.

Machine Learning Models

At the core of AI solutions are machine learning models that can predict outcomes, identify patterns, and make decisions with minimal human intervention. These models are trained on historical data and continuously improve as they are exposed to new data.

Natural Language Processing (NLP)

AI in FinTech utilizes NLP to understand and generate human language, enabling chatbots and virtual assistants to interact with users in a natural, conversational manner. This technology is also used for sentiment analysis and to extract valuable information from unstructured data like emails, social media posts, and financial documents.

Real-Time Processing

AI solutions can process transactions and data in real-time, enabling instant fraud detection, high-frequency trading, and immediate customer service responses. This speed and efficiency are crucial for maintaining competitiveness in the fast-paced financial sector.

Personalization

Through AI, FinTech services can offer personalized recommendations and advice to users based on their financial history, preferences, and goals. This level of personalization enhances customer satisfaction and engagement.

Predictive Analytics

AI's ability to forecast future trends based on historical data is invaluable for risk management, investment strategies, and financial planning. Predictive analytics can identify potential market movements, credit risks, and customer churn, among other things.

Fraud Detection and Security

AI solutions are equipped with sophisticated algorithms capable of detecting fraudulent activities and security threats by identifying anomalies and patterns that deviate from the norm. This proactive approach to security helps protect both the financial institution and its customers.

Regulatory Compliance and Reporting

AI can automate the monitoring and reporting processes required for compliance with financial regulations. By analyzing transactions and customer data, AI systems can ensure that financial services operate within legal and regulatory frameworks, reducing the risk of penalties.

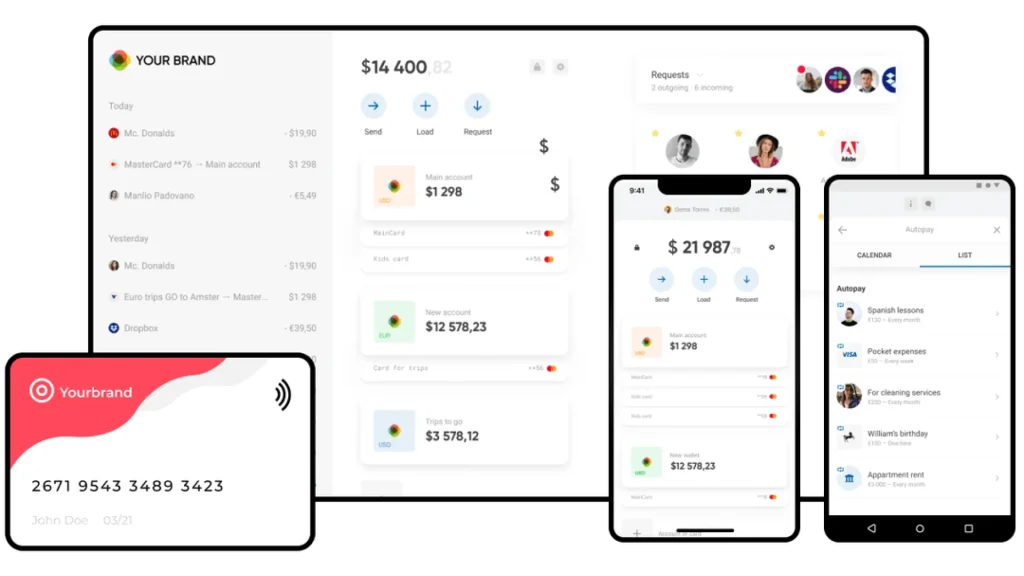

Web3 PaaS Ecosystem for Next-Gen NeoBanking, RegTech, and Secure Data Vaulting

A blockchain-powered PaaS ecosystem enabling financial providers to launch custom neobanking solutions with secure infrastructure.

Additional Info

- Blockchain

- .NET

- Node.js

- AWS

- Docker

- PostgreSQL

- React Native

USA

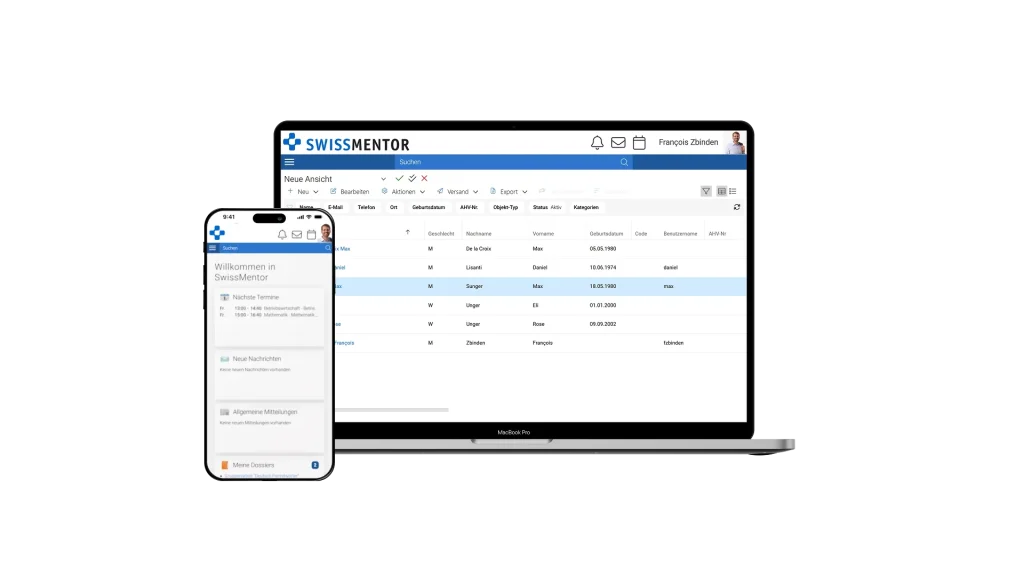

Modular LMS for Multi-Domain Learning: SwissMentor’s Enterprise-Grade Online Platform

A full-featured learning management system built to digitize education workflows, manage courses, and support online learning at scale.

Additional Info

- .NET Core

- PostgreSQL

- Angular

- Docker

- Kubernetes

- Azure

- SCORM

Switzerland

Trusted by

Industry Contribution Awards & Certifications

Check Devox Software Awards on rating & review platforms among top software development companies and Certifications our team members holds.

- Awards

- Certifications

Testimonials

FAQ

-

How AI will improve finance?

AI will significantly improve finance by automating operations, better decision-making thanks to access to data, and personalized customer experiences. Through the use of machine learning and data analytics, financial institutions can process transactions more efficiently and with greater accuracy, reducing costs and minimizing errors. AI-driven fraud detection systems will bolster security, identifying fraudulent activity in real-time and protecting both institutions and their customers.

Additionally, AI enables the creation of innovative financial products tailored to individual needs, improving access and financial inclusion. Ultimately, AI’s integration into finance promises not only to streamline operations but also to revolutionize customer engagement and risk management, setting new standards for the industry’s future.

-

What programming languages and frameworks are commonly used in AI for Fintech development?

In AI for Fintech development, Python leads due to its extensive libraries such as TensorFlow, PyTorch, and Scikit-learn, which are crucial for ML and data analysis. As a financial service company AI software, we often use Java for its performance in high-volume transaction environments, with itsrobust libraries like Deeplearning4j for AI. JavaScript, with libraries like Brain.js, facilitates AI development in web-based fintech applications for real-time user interaction. Frameworks like Keras for deep learning simplify the development process by offering high-level neural networks APIs.

-

How does AI in Fintech ensure compliance with financial regulations?

AI solutions in Fintech incorporate regulatory compliance by using natural language processing (NLP) to monitor and analyze changes in regulations automatically. AI fintech machine learning models are trained on historical compliance data to predict potential compliance issues in real-time transactions. These models are regularly updated to reflect the latest regulatory requirements, ensuring ongoing compliance. Additionally, AI systems can generate detailed audit trails of all financial activities, aiding in transparency and accountability during regulatory reviews or audits.

-

What are the expected developments in AI for Fintech over the next few years?

Expected developments in the AI finance industry include advancements in predictive analytics for more accurate financial forecasting, personalized AI-driven financial advice for customers, and enhanced risk management through deeper learning algorithms. We also anticipate growth in AI-powered regulatory technology (RegTech) for more efficient compliance processes. Furthermore, the integration of quantum computing could revolutionize AI capabilities in fintech by significantly speeding up data processing and complex calculations.

-

Can AI in Fintech be integrated with existing banking systems?

Yes, AI in finance sector is designed to integrate seamlessly with existing banking systems through APIs and microservices architecture. This integration facilitates real-time data exchange and process automation without disrupting existing workflows. Custom AI models can be developed to work within the constraints of legacy systems, ensuring that banks can leverage AI benefits such as improved customer service and fraud detection without extensive infrastructure overhaul.

-

What role does AI play in blockchain applications for Fintech?

In blockchain applications for fintech, AI plays a crucial role in optimizing transaction processing, enhancing security, and providing predictive analytics for investment decisions. AI algorithms can analyze blockchain data to identify trends and patterns for better financial forecasting.

Additionally, AI finance can improve the efficiency of consensus mechanisms in blockchain networks, reducing the time and energy required for transaction verification. It also enhances security by detecting potential fraud in blockchain transactions and smart contracts.

Want to Achieve Your Goals? Book Your Call Now!

We Fix, Transform, and Skyrocket Your Software.

Tell us where your system needs help — we’ll show you how to move forward with clarity and speed. From architecture to launch — we’re your engineering partner.

Book your free consultation. We’ll help you move faster, and smarter.

Let's Discuss Your Project!

Share the details of your project – like scope or business challenges. Our team will carefully study them and then we’ll figure out the next move together.

Thank You for Contacting Us!

We appreciate you reaching out. Your message has been received, and a member of our team will get back to you within 24 hours.

In the meantime, feel free to follow our social.

Thank You for Subscribing!

Welcome to the Devox Software community! We're excited to have you on board. You'll now receive the latest industry insights, company news, and exclusive updates straight to your inbox.