Gain access to a broader base of investors and quicker liquidity as a property owner or developer: provide fractional ownership of real estate, enabling investors to purchase small portions of property by lowering the investment threshold. We can tokenize residential, commercial, and undeveloped land, making diverse portfolios more accessible to average investors.

Asset Tokenization Company

What is Asset Tokenization?

Tokenization is a process of transferring the asset’s ownership from a physical medium to a blockchain token. Most often, an asset like this can be corporate equity, debt, real estate, a financial instrument; it can also be intellectual property, commodities, art and collectibles.

Tokenization of assets makes investing in them much more accessible because it allows breaking large, expensive items into small fractions, which are cheaper and may be conveniently purchased online. Usually, with tokenization companies raise capital from numerous individual investors. Also, tokens are easier to trade than conventional forms of securities, which makes them even more attractive to investors.

Asset Tokenization Services We Provide

The essence of asset-backed tokenization lies in transferring those assets to blockchain, which opens up a number of opportunities concerning their management. See what we can help you with and what is unfolding for your business.

-

Tokenization of Real Estate Assets

-

Art and Collectibles Tokenization

Promote unknown or beginning artists and enable them to monetize their art in a better way. We will convert ownership of valuable art and collectibles into NFTs (non-fungible tokens), run a collection on an NFT marketplace or create the marketplace itself. Simplify the process of buying, selling, and trading these items while ensuring provenance and authenticity are maintained through the blockchain’s immutable ledger.

-

Financial Instruments Tokenization

Tokenize stocks, bonds, and other financial instruments to make them more liquid and accessible. You will democratize access to investment opportunities, trading them on secondary markets much like stocks but with potentially lower transaction costs and faster settlement times thanks to the elimination of many intermediaries.

-

Commodity Tokenization

Allow fractional ownership and ease of trading of assets like gold, oil, and agricultural products, opening commodity markets to smaller investors and providing more flexible, market-driven pricing mechanisms. Enable these commodities’ producers and consumers with new ways to hedge against price volatility without the need for traditional futures contracts.

-

Intellectual Property Tokenization

Be it patents, trademarks, and copyrights, tokenization will streamline royalty payments and licensing processes. This service provides creators more direct control and potentially greater earnings from their intellectual assets by automating royalty distributions and reducing dependency on intermediaries. It also facilitates more granular and flexible IP rights management, enabling IP owners to sell or license parts of their rights more efficiently.

-

Private Equity and Fund Tokenization

Transform traditional private equity investments into more liquid assets. Your company will raise capital by offering equity stakes through digital tokens, which can be traded more freely than conventional private equity shares. Lower entry barriers for investors and speed up capital formation for businesses.

-

Infrastructure and Project Finance Tokenization

Raise funds for infrastructure projects through the issuance of digital tokens. You will get more distributed investment in public and private projects, lowering financing costs and improving capital allocation efficiency. It also allows for innovative funding models, such as small-scale public investments in local projects.

Benefits of Asset Tokenization

Real-world asset tokenization lets you puts you in more control of your operations and investors relations than traditional ownership could ever offer. See what will be enabled with the power of blockchain.

-

Untie Your Asset’s Potential

Eliminate the conflict between reliability and liquidity in any asset in question. Traditionally illiquid real estate or art become more flexible thanks to fractional ownership (an act of breaking one token into several smaller tokens), which will attract smaller investors and sell tokens quickly without dumping the price.

-

Dictate Your Own Terms to Investors

Leverage the possibilities of fractional ownership to sell your token quicker, getting a myriad of investors interested. By breaking down expensive assets into smaller, more affordable units, tokenization democratizes access to investments previously available only to wealthy individuals or institutional investors. Moreover, having a lot of small investors over a single big one preserves your bargaining power as a token issuer.

-

Easy Regulatory Compliance

Comply with every SEC regulation by design and don’t lose on international investors regardless of their locations. Tokenization platforms can integrate regulatory requirements into the token design, ensuring compliance with local and international laws automatically even in highly regulated sectors like finance and real estate.

-

Faster, Transparent, Secure

Transactions recorded on a blockchain are immutable and transparent, reducing the potential for fraud and making it easier to track the history and ownership of an asset. Moreover, this transparency cuts the need for intermediaries like brokers and lawyers, lowering operational cost and speeding up the process.

Key Features of Tokenized Assets

Fractional Ownership

Tokenization allows assets to be divided into smaller, more affordable units. This enables investors to purchase fractions of an asset, making it accessible to a wider audience and increasing the asset's liquidity.

Global Accessibility

Tokens can be bought and sold on global markets, enabling worldwide trading without the traditional geographic or regulatory barriers. This broadens the investor base and enhances the potential for liquidity.

Immutability and Transparency

Once a transaction is recorded on a blockchain, it cannot be altered, ensuring a permanent and transparent record of ownership and transaction history. This feature significantly reduces the potential for fraud and increases trust among investors.

Programmability

Tokens can be programmed with smart contracts that execute automatically based on predefined rules and conditions. This can include automated dividend payments, implementation of compliance regulations, or other conditional operations without human intervention.

24/7 Market Operations

Unlike traditional markets that have set hours, blockchain platforms enable round-the-clock trading of tokenized assets. This allows for continuous access to the market, which can lead to more dynamic pricing and quicker trades.

Interoperability

Tokenized assets can be designed to be interoperable across different blockchain platforms and systems. This facilitates a seamless exchange and interaction of assets across diverse platforms and increases their utility.

Reduced Transaction Costs

By eliminating or reducing the need for intermediaries like brokers, lawyers, and banks, tokenization can significantly lower the costs associated with buying, selling, and managing assets.

Enhanced Security

Blockchain technology provides robust security features that protect against hacking and unauthorized access. Tokenized assets benefit from this security, safeguarding investor interests and asset integrity.

Industry Contribution Awards & Certifications

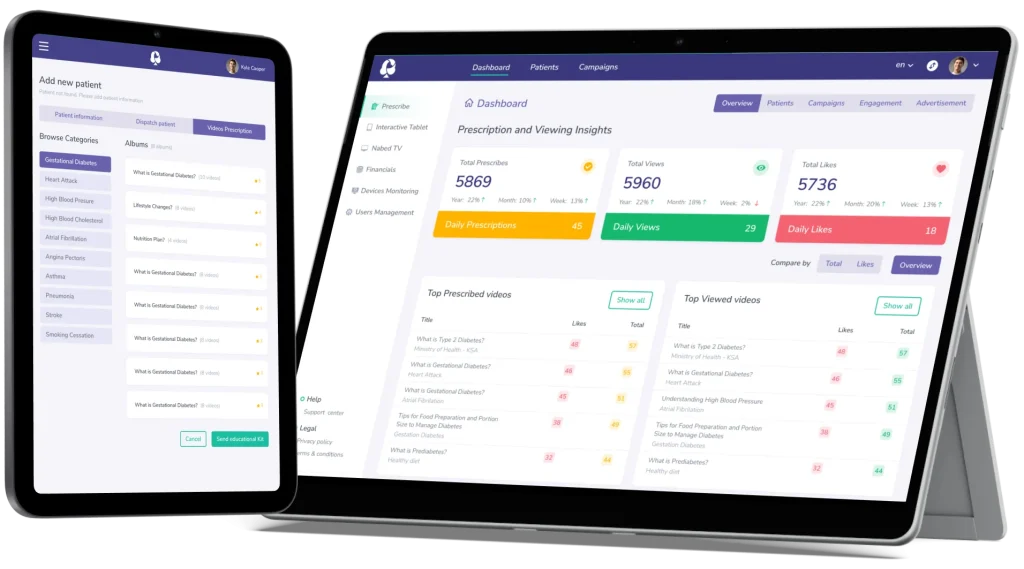

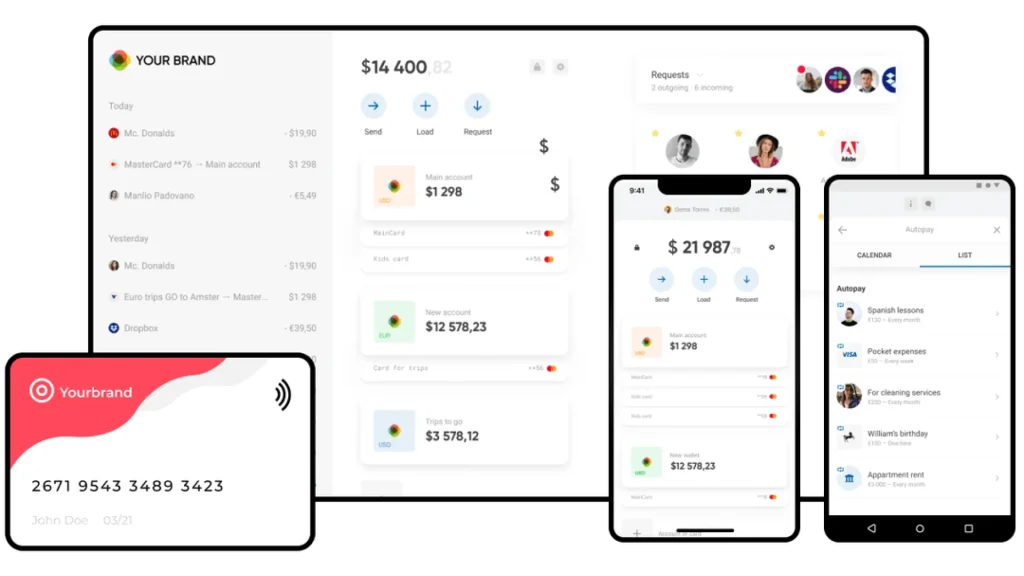

Web3 PaaS Ecosystem for Next-Gen NeoBanking, RegTech, and Secure Data Vaulting

A blockchain-powered PaaS ecosystem enabling financial providers to launch custom neobanking solutions with secure infrastructure.

Additional Info

- Blockchain

- .NET

- Node.js

- AWS

- Docker

- PostgreSQL

- React Native

USA

Testimonials

FAQ

-

What exactly does asset tokenization mean?

Asset tokenization services refer to the process of converting ownership rights in a real-world asset into a digital token on a blockchain. These tokens represent a share or stake in the underlying asset, which could be anything from real estate and art to corporate stocks and commodities. The benefit of this process is that it provides increased liquidity, makes fractional ownership possible, and enhances the efficiency of trading and managing these assets.

-

Can any asset be tokenized?

Virtually any asset can be tokenized, provided it has a definable value and clearly establishes ownership. Commonly tokenized assets include real estate, fine art, precious metals, and financial instruments like stocks or bonds. Even less tangible assets, such as intellectual property or revenue streams from projects, can be tokenized. The key is to ensure that the legal and regulatory frameworks support the tokenization of these asset types.

-

Which industries are most impacted by asset tokenization?

Asset tokenization on blockchain has profound implications across various industries, but the most significant impact is seen in real estate, finance, art, and commodities. In real estate, tokenization simplifies transactions, enhances liquidity, and opens up investment opportunities to a broader audience. In finance, it brings efficiency and transparency to transactions involving stocks and bonds. The art industry benefits from improved provenance tracking and democratization of ownership, while the commodities market sees enhanced trading efficiency and accessibility.

-

What is digital asset tokenization?

Digital asset tokenization involves converting digital assets such as artwork, music, videos, and other forms of digital content into secure digital tokens on a blockchain. This process grants easier access and ownership distribution by enabling fractional ownership of digital assets.

Tokenization of digital assets brings about greater liquidity, allowing these assets to be traded more freely on various online platforms. It enhances security and ensures transparency since every transaction is immutably recorded on the blockchain. Additionally, smart contracts automate many operations such as rights management and royalty payments, significantly reducing the need for intermediaries. Digital asset tokenization not only streamlines the way we handle and trade digital content but also expands the potential for creators to monetize their work in new and innovative ways.

-

How does tokenization enhance asset liquidity?

Tokenization enhances asset liquidity by allowing fractional ownership and easing the entry barriers for potential investors. By breaking down large assets into smaller, more affordable units, more investors can participate in the market, increasing the asset’s trading activity and market fluidity. This not only quickens the pace at which these assets can be bought and sold but also helps in discovering more accurate market prices through increased transactions.

-

What are the legal considerations for tokenizing an asset?

The legal considerations for tokenizing an asset include ensuring compliance with securities laws, tax implications, and adherence to anti-money laundering regulations. Depending on the jurisdiction and the type of asset, specific regulations may need to be addressed. For instance, if the token represents a financial security, it must comply with the relevant securities regulations in each country where the tokens will be offered or traded. Establishing a clear legal framework that defines the rights and obligations associated with the token is crucial to its success and legitimacy.

Want to Achieve Your Goals? Book Your Call Now!

We Fix, Transform, and Skyrocket Your Software.

Tell us where your system needs help — we’ll show you how to move forward with clarity and speed. From architecture to launch — we’re your engineering partner.

Book your free consultation. We’ll help you move faster, and smarter.

Let's Discuss Your Project!

Share the details of your project – like scope or business challenges. Our team will carefully study them and then we’ll figure out the next move together.

Thank You for Contacting Us!

We appreciate you reaching out. Your message has been received, and a member of our team will get back to you within 24 hours.

In the meantime, feel free to follow our social.

Thank You for Subscribing!

Welcome to the Devox Software community! We're excited to have you on board. You'll now receive the latest industry insights, company news, and exclusive updates straight to your inbox.