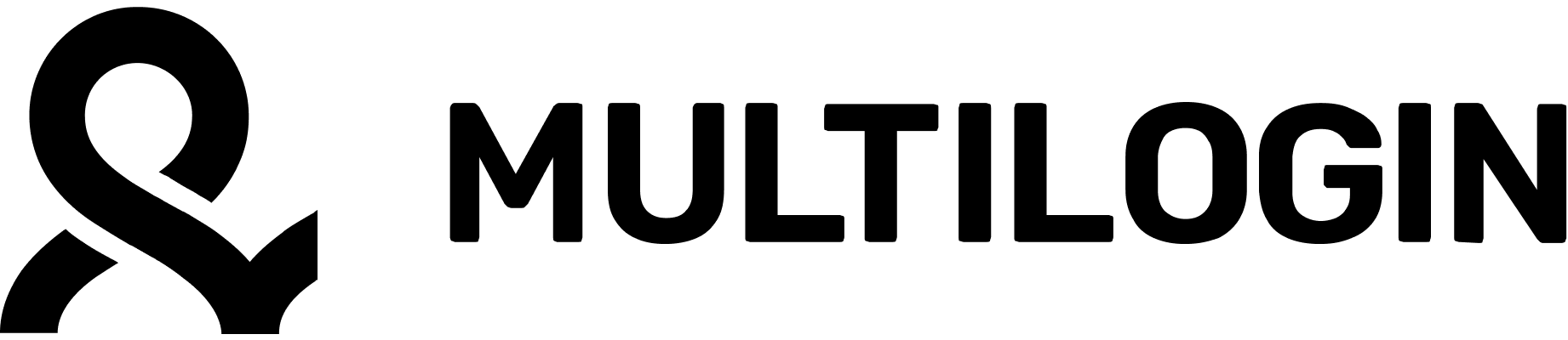

Revolutionize the payments for your community by providing a secure and user-friendly brand-labeled cryptowallet. Web3 allows for a rich set of features and mechanics, bypassing traditional banking intermediaries and making cross-border transactions faster and more cost-effective.

Blockchain for Fintech Development Services

There are many applications of blockchain technology in financial services. Devox can develop solutions that will help your business and your clients leverage the promise of Web3.

-

Payment Solutions and Wallet Development

-

Smart Contracts Development

Smart contracts are the backbone of blockchain: they automate financial agreements, executing them automatically under predetermined conditions, reducing the need for intermediaries and lowering the risk of fraud. Streamline insurance payouts, quicken loan approvals, and boost compliance enforcement.

-

Tokenization Services

Convert any asset’s ownership into a blockchain token. Be it real estate, stocks, bonds, art or even collectibles, tokenization will democratize the process of investing in them, provide transparency and traceability, and give you more bargaining power as an issuer.

-

Security Token & STO Development

We can tokenize your securities, bonds, and obligations, shaping them into security tokens. If you wish to issue them to investors, we can help you conduct a Security Token Offering (STO)—an analog of an IPO on blockchain.

-

Decentralized Finance (DeFi) Solutions

Devox can build platforms for lending, borrowing, trading, and investing without traditional financial intermediaries, leveraging smart contracts to create transparent and accessible financial services. Get a branded DEX, a tailored protocol, or swapping platform similar to Uniswap, SushiSwap or PancakeSwap.

-

Regulatory and Compliance Automation

Leverage blockchain and its bulletproof yet transparent architecture to facilitate easier audits, automate compliance processes, adhere to KYC (Know Your Customer) and AML (Anti-Money Laundering) guidelines and generally raise trust for your company, contributing to an image of transparency.

-

Fraud Reduction Systems

Prevent fraud in areas such as payment systems and identity verification, where ensuring the legitimacy of involved parties is crucial. The inherent security features of blockchain like immutability and encryption make it highly resistant to fraud. Blockchain will let you track the lifecycle of a transaction or an asset with absolute certainty of the record’s authenticity.

-

Identity Management Solutions

Devox can create and incorporate an NTT (non-transferable token) to your ecosystem or blockchain. You will verify your users with ease and no chance of mistake, providing them with an effortless security. Such systems can also be used for customer onboarding, continuously updating and verifying customer details with reduced risk of data breaches or unauthorized access.

Benefits of Custom Blockchain for Fintech Development

When companies implement blockchain in financial industry, they gain space for new sources of funding, investors, financial opportunities and security. Read how exactly can Web3 make your business better.

-

Address Transaction Times & Costs

Traditional financial systems often involve lengthy and expensive clearing and settlement processes, especially in cross-border transactions. Blockchain facilitates real-time transaction processing, significantly speeding up these operations and reducing waiting times for businesses and consumers. By eliminating the need for intermediaries like banks and payment processors, it substantially reduces fees associated with transactions and financial services, too.

-

Provide Secure and Private Financial Environment

Eliminate the possibility of security breaches, fraud, and cyber attacks. The decentralized and tamper-evident nature of blockchain enhances security by making it nearly impossible to alter stored data without detection across the entire network. On the way, you will manage and secure vast amounts of data while maintaining privacy a lot easier than before, retain better control over data, and generally contribute to privacy through cryptographic techniques. Lack of Trust among Parties. In traditional finance, trust is heavily reliant on intermediaries. Blockchain creates a trustless environment where transactions and data are verifiable by all parties involved, thereby reducing dependency on any single entity and increasing overall trust.

-

Tap Into Regulatory Compliance and Transparency

Applications of blockchain in finance allow financial institutions to improve previously cumbersome regulatory compliance through more effective monitoring, reporting, and data management capabilities. Blockchain's immutable nature helps ensure the accuracy and integrity of records necessary for this as it provides an immutable audit trail and transparent operations, simplifying compliance, enhancing transparency, and easing regulatory reporting and monitoring.

-

Increased Liquidity

Expand your market opportunities and access to capital thanks to newest mechanics. Tokenization (the process of transferring an asset’s ownership to blockchain) is an act of boosting any asset’s liquidity tenfold: as a token, it becomes tradable, can now be divided into fractions to be sold in parts, and access the secondary market. Traditionally illiquid real estate, art, or certain types of debt will be bought and sold more rapidly and with less price compromise.

-

Broad Market Access

Traditional investing in certain assets or participating in specific financial markets requires significant capital, special relationships, or specific geographical presence. Blockchain democratizes this approach, providing access to digital assets through a decentralized network that does not require intermediaries such as banks or brokers. Lower entry barriers for investors from different economic backgrounds and countries, reaching a broader audience that does not require traditional banking infrastructure.

-

Attract More Different Investors

Appeal to a much wider pool of investors, making it feasible for smaller investors to participate alongside institutional ones. Regardless of their contribution number, they will enjoy a lowered investment threshold, easy and transparent exit strategies and security features, while you as a token issuer will preserve bargaining power - something traditional institutional investing doesn’t allow for company owners.

Key Features of Custom Blockchain for Fintech

Distributed Ledger Technology (DLT)

This is the foundation of blockchain, where a ledger of transactions is distributed across multiple nodes in a network, rather than being stored on a central server. Each node has a copy of the entire ledger, ensuring transparency and redundancy, which helps prevent data loss and tampering.

Cryptography

Blockchain relies heavily on cryptographic techniques to ensure the security and integrity of data. Public-private key pairs are used to create digital signatures that verify the authenticity and integrity of transactions, ensuring that they can only be accessed or modified by authorized users.

Consensus Mechanisms

This component is crucial for maintaining the blockchain's decentralized integrity. It involves methods for agreeing on the validity of transactions across different nodes without a central authority. Common consensus algorithms include Proof of Work (PoW), Proof of Stake (PoS), and Delegated Proof of Stake (DPoS), among others.

Smart Contracts

These are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. Smart contracts automate the execution of agreements and ensure that all parties adhere to the terms without the need for intermediaries.

Blockchain Protocol and Network

This refers to the specific finance blockchain architecture and the rules that govern its operations, including how transactions are initiated, validated, recorded, and communicated within the network.

Nodes

In blockchain technology, a node is any active device connected to the blockchain network that participates in activities such as transaction verification and consensus. Nodes are critical for the decentralized and distributed nature of blockchain.

Mining (in some blockchains)

This is the process of validating new transactions and recording them on the blockchain. In networks like Bitcoin, mining involves solving complex cryptographic challenges that require computational power and, in return, miners are rewarded with cryptocurrency.

APIs (Application Programming Interfaces)

APIs are used for interacting with the blockchain network, allowing applications to send and receive data from the blockchain, initiate transactions, and access blockchain functionalities.

Transaction Pool

Before transactions are confirmed and added to the blockchain, they are held in the transaction pool (or memory pool). This is a sort of waiting area for all ongoing transactions.

Blocks

Blocks are data structures within the blockchain where transaction data is permanently recorded. A block records some or all of the most recent blockchain transactions that have not yet entered any prior blocks. Each block is connected to the previous block, forming a chain.

Industry Contribution Awards & Certifications

Check Devox Software Awards on rating & review platforms among top software development companies and Certifications our team members holds.

- Awards

- Certifications

Web3 PaaS Ecosystem for Next-Gen NeoBanking, RegTech, and Secure Data Vaulting

A blockchain-powered PaaS ecosystem enabling financial providers to launch custom neobanking solutions with secure infrastructure.

Additional Info

- Blockchain

- .NET

- Node.js

- AWS

- Docker

- PostgreSQL

- React Native

USA

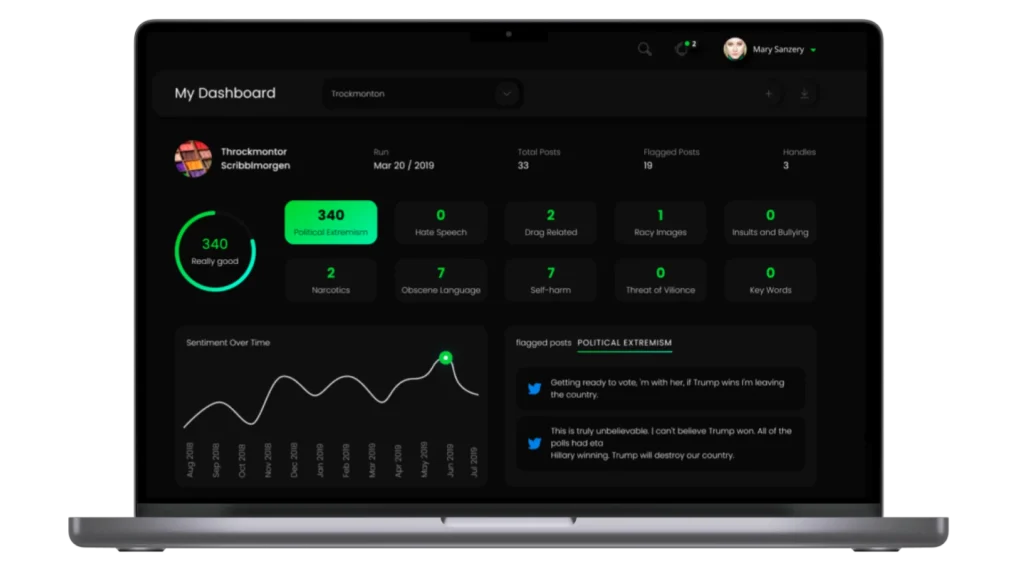

AI-Powered Social Media Background Check Platform for Risk-Free Hiring

An AI-driven platform for HR teams to automate social media background checks and mitigate hiring risks.

Additional Info

- .NET Core

- Angular

- Azure

- Docker

- GitLab CI/CD

- Selenium Web Driver

USA

Testimonials

FAQ

-

How does blockchain technology enhance security in fintech applications?

Blockchain enhances security by using advanced cryptography that ensures data integrity and confidentiality. Every transaction on a blockchain is encrypted and linked to the previous transaction, making it virtually impossible to alter any information without detection. Additionally, the decentralized nature of blockchain means that no single point of failure can compromise the security of the entire system. For fintech, financial software blockchain means safer transactions, reduced fraud, and enhanced user trust, which are critical in handling sensitive financial data and large volumes of transactions.

-

Can blockchain solutions be integrated with existing financial systems?

Yes, blockchain in finance sector can be integrated with existing financial systems through APIs and middleware that facilitate data exchange and communication between blockchain networks and traditional financial databases. This integration allows financial institutions to leverage the immutability and transparency of blockchain while maintaining their existing infrastructure. Such integrations are crucial for phased adoption, enabling banks and financial services to gradually implement blockchain functionalities like real-time settlements, enhanced KYC processes, and fraud prevention systems without disrupting their ongoing operations.

-

What are the benefits of using smart contracts in fintech?

Smart contracts automate complex financial agreements, execute transactions automatically upon meeting agreed conditions, and store the terms digitally on the blockchain. In fintech, this reduces the need for intermediaries, which lowers transaction costs and minimizes delays. Smart contracts also provide a higher level of security and reduce the likelihood of disputes, as the contract execution is transparent and immutable. For example, in trade finance, smart contracts can automatically release payments when goods are received, significantly speeding up transactions and reducing paperwork.

-

How does blockchain help fintech companies comply with regulations?

Blockchain offers an exceptional level of traceability and transparency that is beneficial for regulatory compliance. Every transaction recorded on a blockchain is immutable and time-stamped, providing an indelible audit trail that aids in meeting stringent regulatory requirements for data integrity and reporting. For fintech companies, this means easier adherence to AML (Anti-Money Laundering), CFT (Combating the Financing of Terrorism), and KYC (Know Your Customer) regulations. Additionally, blockchain can be programmed to automatically enforce compliance through smart contracts, reducing the risk of human error and ensuring continuous compliance with evolving regulations.

-

How does blockchain improve transaction speeds and reduce costs in financial services?

Blockchain technology significantly reduces the time and cost associated with traditional financial transactions, particularly in cross-border payments. By eliminating intermediaries and reducing transaction fees, blockchain allows for near-instantaneous settlements at a fraction of the cost of conventional banking systems. This is especially beneficial for international trade, where blockchain can streamline payments, clearances, and settlements, enabling more efficient and cost-effective financial operations. For fintech, leveraging blockchain means offering customers faster, cheaper, and more reliable services, enhancing customer satisfaction and competitive advantage.

-

Is custom fintech blockchain better than IBM software crypto banking and how?

Whether a custom fintech blockchain is better than IBM software crypto banking depends on specific business needs and requirements. Custom fintech blockchains offer tailored solutions designed precisely to a company’s unique needs, providing flexibility and specific features that off-the-shelf solutions like IBM might not offer. However, IBM’s solutions are backed by extensive research, established infrastructure, and support, making them reliable and secure for enterprises that require proven, scalable solutions.

IBM also provides an integration-friendly platform that can reduce development time and ensure compliance with regulatory standards. Thus, the choice between custom and IBM solutions should be based on the balance between the need for customization and the benefits of a robust, tested platform.

Want to Achieve Your Goals? Book Your Call Now!

We Fix, Transform, and Skyrocket Your Software.

Tell us where your system needs help — we’ll show you how to move forward with clarity and speed. From architecture to launch — we’re your engineering partner.

Book your free consultation. We’ll help you move faster, and smarter.

Let's Discuss Your Project!

Share the details of your project – like scope or business challenges. Our team will carefully study them and then we’ll figure out the next move together.

Thank You for Contacting Us!

We appreciate you reaching out. Your message has been received, and a member of our team will get back to you within 24 hours.

In the meantime, feel free to follow our social.

Thank You for Subscribing!

Welcome to the Devox Software community! We're excited to have you on board. You'll now receive the latest industry insights, company news, and exclusive updates straight to your inbox.