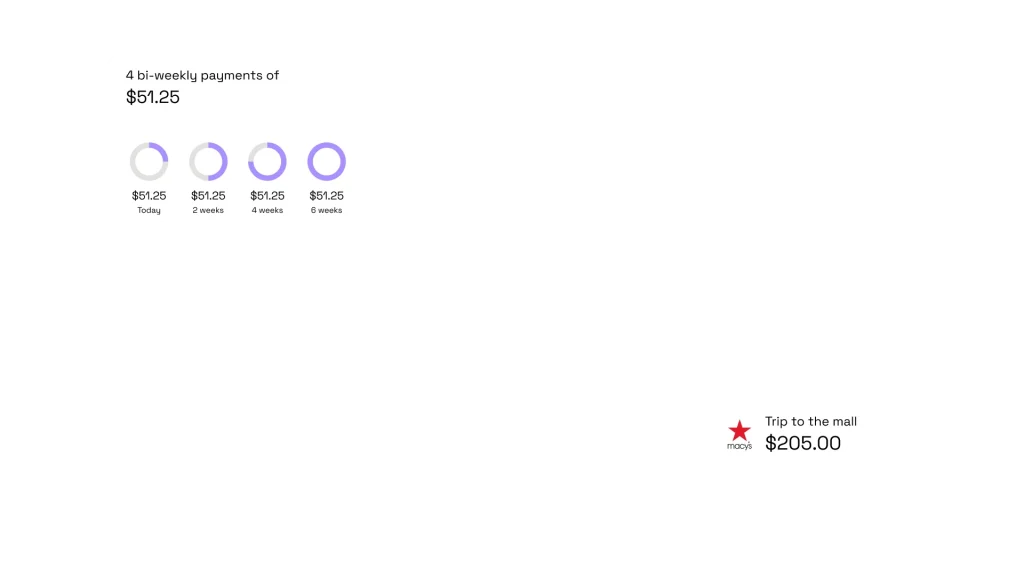

The company’s flagship product is a “split-in-four” checkout API and merchant portal that lets shoppers break purchases into interest-free installments while retailers get paid up front. Early traction was strong, but the platform’s original monolith — an overgrown ASP.NET MVC app — was straining under peak-season traffic, reconciliation delays, and an ever-growing list of compliance stories. When the CTO came to us, he needed two things before the next investor demo: sub-second loan decisions and more predictable AWS costs.

We proposed a light-touch rebuild, rather than a full rip-and-replace rebuild. Over a six-week discovery sprint, we carved the credit-decision engine out of the monolith, rewrote it in ASP.NET Core as a stateless API, and fronted it with an event queue, so approvals returned in under 300 ms even during flash sales. Parallel teams decomposed reporting jobs into Lambdas and shifted static merchant assets to S3+CloudFront, trimming nightly batch windows and halving storage spend. The result: a leaner, auditable BNPL backbone ready for scale without a single minute of service blackout.