-

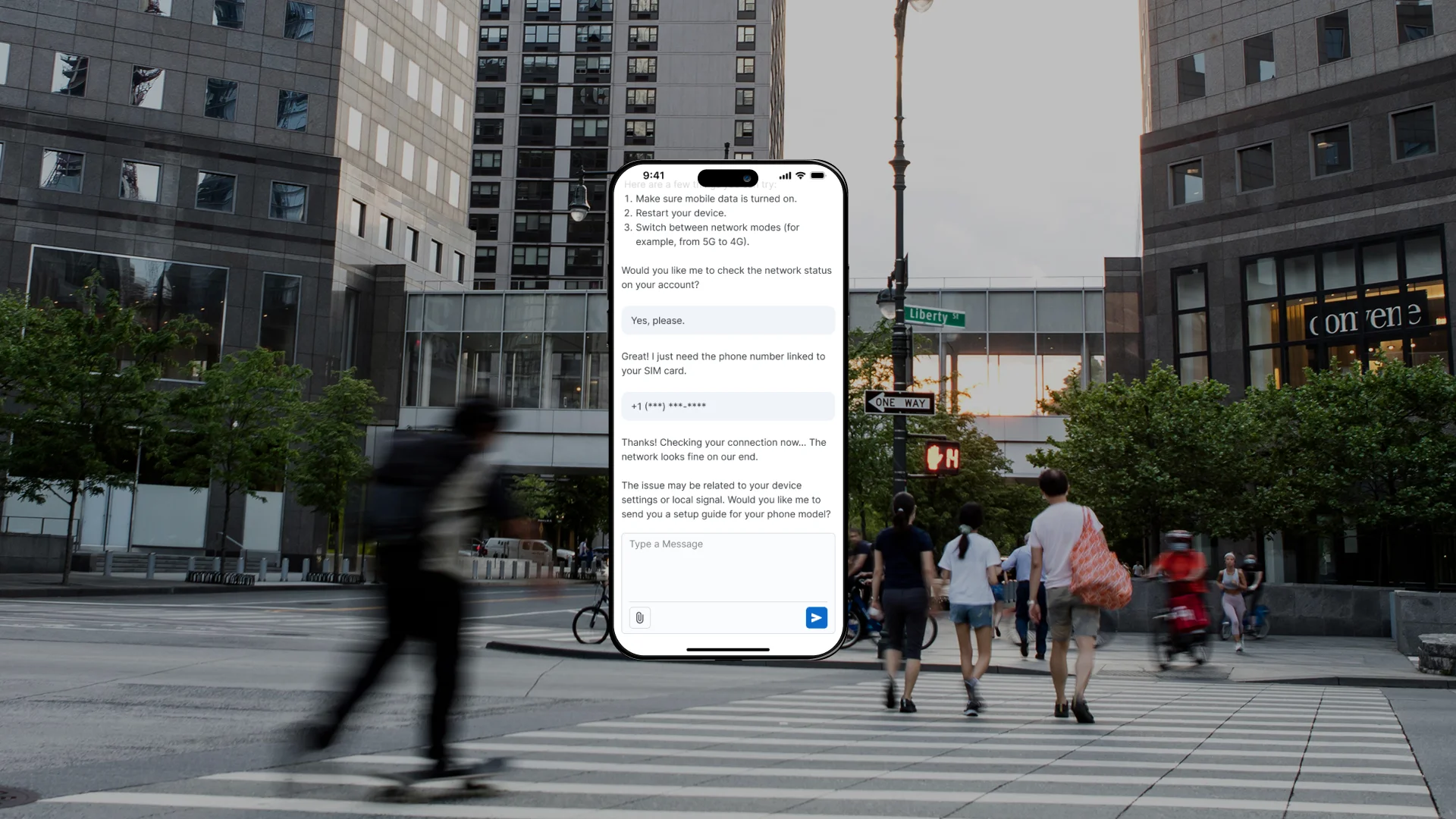

43 Reviews

-

Trusted by

-

100% GDPR COMPLIANCE

-

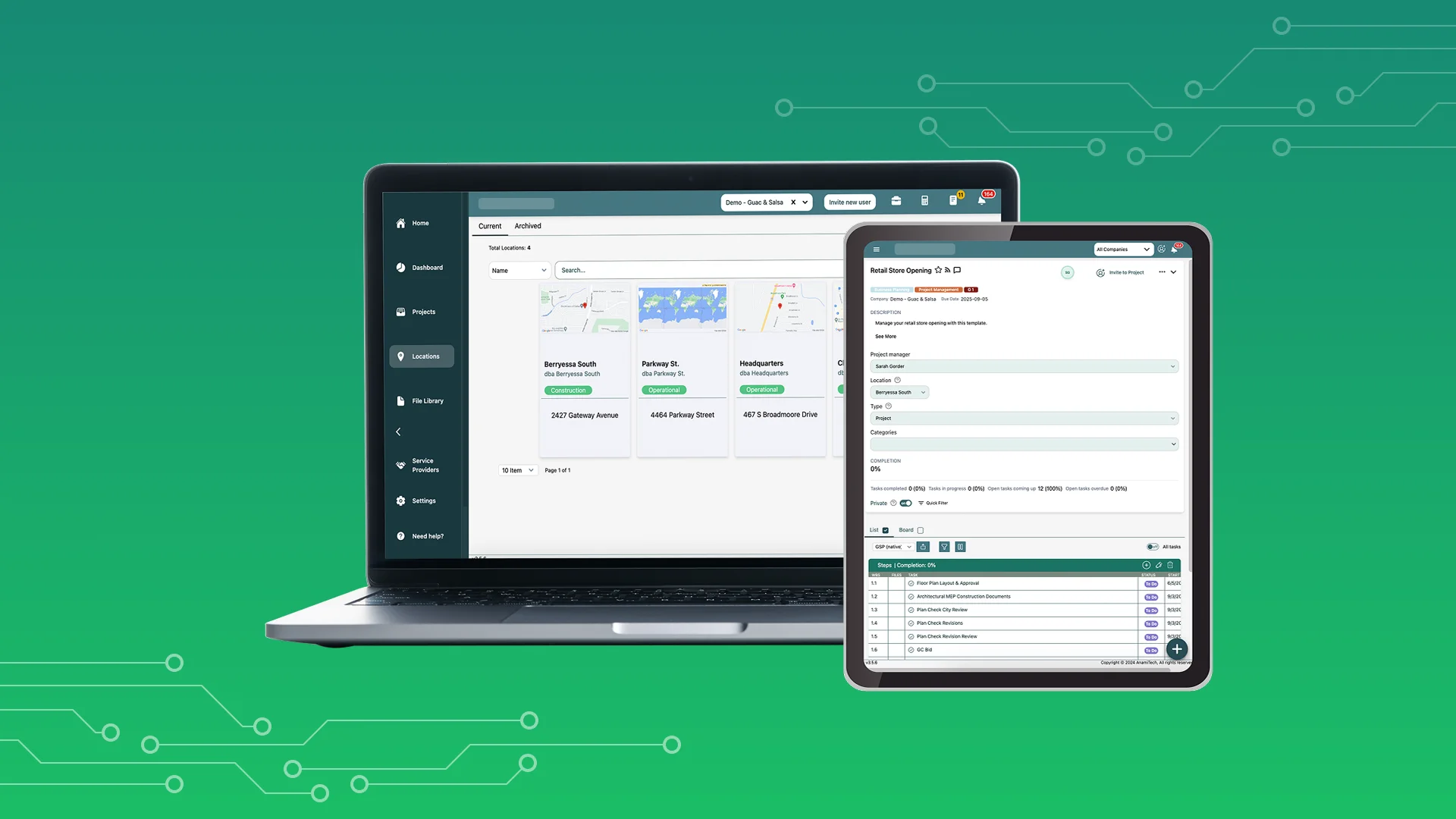

Top IT Services Companies

-

Top IT Services Company

-

Quality in Accordance to ISO 9001:2015

-

Top Custom Software Development Companies

-

Security in Accordance to ISO 27001:2013