Table of content

The logistics sector is in the midst of a massive overhaul, forced to move away from outdated systems and adopt the streamlined, high-tech supply chains of the future that run on AI. And it’s not just some pie-in-the-sky vision: it’s being driven by the harsh realities of economic ups and downs, the ever-present threat of global conflict, regulatory pressure increasing across the industry, and new technologies eager to enter and reshape the industry. This research project explores the most impactful trends, predictions, challenges and opportunities for 2026, focusing on areas that’ll really make a difference: AI decision-making in the fast lane, using automation to get warehouse and transportation operations up to speed and ensuring that supply chains are seamlessly integrated and resilient We took a global approach, but placed a particular focus on developments in the US, where the infrastructure is already highly advanced and AI adoption rates are way higher than they are in most places.

Those legacy systems that continue to hinder operational efficiency — the rigid IT frameworks and the data stuck in separate little worlds — are still the biggest hindrance to getting things done in logistics. These legacy systems cannot access and act on real-time data efficiently. Then there are sectors like trucking and third-party logistics, where outdated processes are just exacerbating the existing issues — think excess inventory and delays, for example. Together, these constraints turn logistics execution into a reactive exercise, where teams spend more time compensating for system blind spots than actually optimizing flow, cost, and service levels.

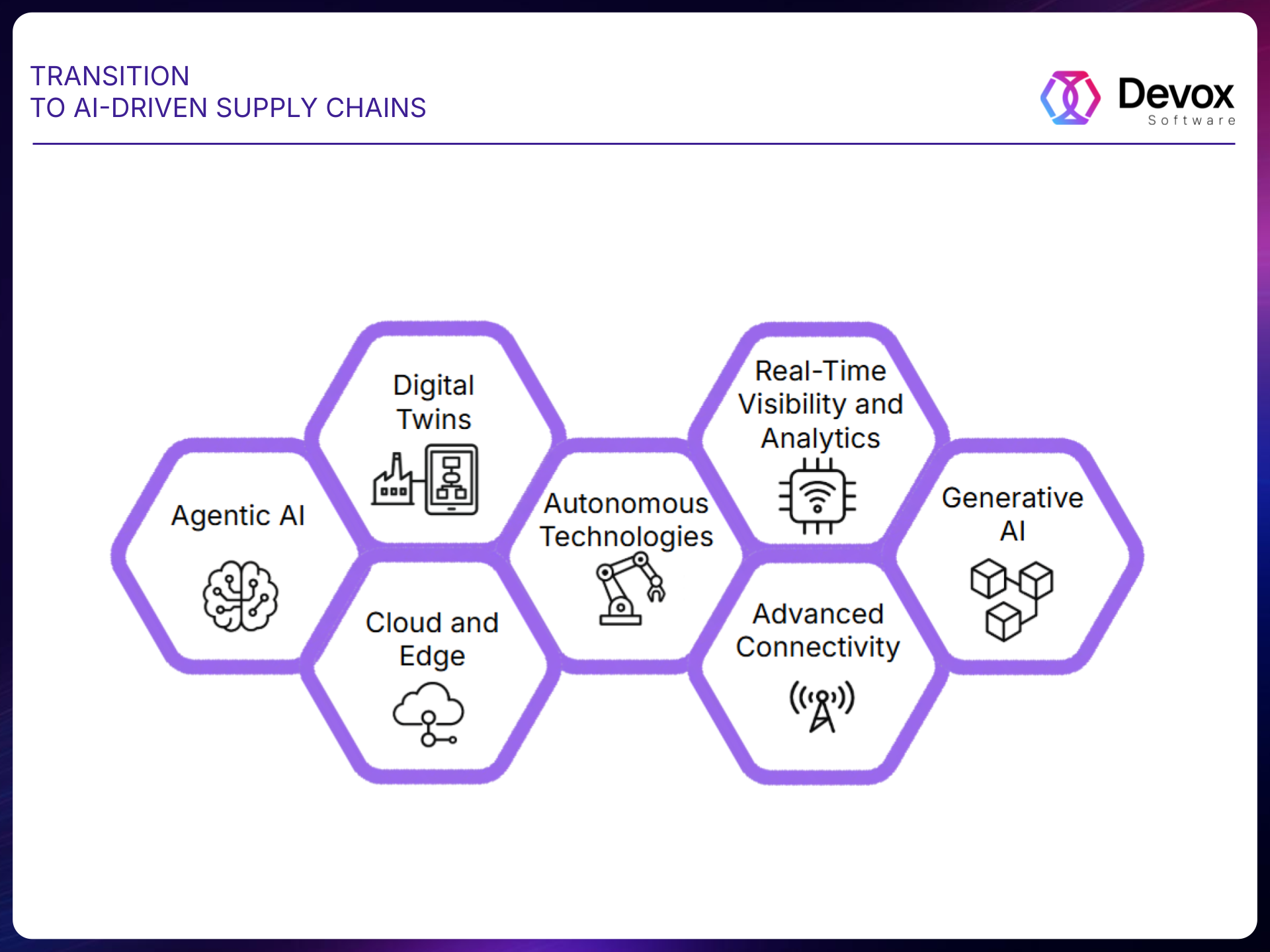

Transition to AI-Driven Supply Chains

The shift from old to new systems is all about bringing generative AI (GenAI), agentic AI, and advanced connectivity together so that operations can be done independently. By 2026, over 80% of enterprises will deploy GenAI-enabled applications, facilitating pattern recognition, decision-making, and workflow optimization in logistics.

Statistically, the US trucking industry, a cornerstone of logistics, relies heavily on traditional methods, but technology adoption is accelerating. 33% automation/27% augmentation in chains; US leads readiness (RandD/finance), Europe (Nordics/Belgium 24-28% adoption); 2025-2026 gaps widen without reskilling.

Agentic AI, acting as “virtual coworkers,” handles multistep tasks like last-mile coordination, with equity investments reaching $1.1 billion in 2024 and job postings surging 985% year-over-year. US-specific examples include Amazon’s AI cobots for pick-and-place tasks and Waymo’s autonomous vehicles expanding ride-hailing and robo-trucks in Texas. SCM software trends emphasize AI analytics for insights, with the US benefiting from developed infrastructure.

By 2027, we’ll see the whole logistics industry really pivot and think more about AI-driven supply chains. They’ll be overcoming the old way of doing things thanks to more investment in areas like agentic AI, connectivity, and, of course, robotics. Leaders must prioritize governance, upskilling, and pragmatic implementations to realize $4.4 trillion in global productivity gains, with the US poised to lead due to its tech ecosystem. This all adds up to more competitive and more responsive companies that will be better placed to cope in an increasingly unpredictable world.

AI in Logistics

These statistics paint a picture of change happening — fast but not all at the same pace: AI systems designed for autonomous task execution are supposed to revolutionise logistics (think picking the right inventory and routing, for instance). But beforehand, there are some pretty big hurdles to clear, like getting old systems to work with new ones & the cost and all the hype surrounding it — it may hold it back from really taking off by 2027. These projections make it pretty clear that GenAI has a real role to play in making logistics more efficient, but also make it clear that it’s going to take some smart planning to get past those old systems and actually reap the rewards by 2027.

- AI spending to exceed $512B globally by 2027 (GenAI 28%), with CAGRs >90% for infrastructure; US/Europe focus on augmented logistics (e.g., preventative maintenance).

- By the end of 2026, 40% of enterprise applications (including those in supply chain and logistics) will integrate task-specific AI agents, up from less than 5% in 2025, enabling autonomous execution in areas like warehouse operations and route optimization.

- In 2025, 23% of organizations are scaling agentic AI systems enterprise-wide, with an additional 39% experimenting; in supply chains, this includes agents for adaptive orchestration, such as rerouting logistics during disruptions.

- Reshoring to enhance resilience, intersecting with AI for predictive analytics in volatile environments; 2026 forecasts show mega-cap deceleration, enabling logistics sectors to adopt agentic AI.

- Agentic AI in logistics could deliver $30-35 million in savings for large fleets (e.g., 10,000+ vehicles) through virtual dispatcher agents that assist with troubleshooting and roadside coordination, with investments as low as $2 million in 2025.

- Over 40% of agentic AI projects (including those in supply chain tech) will be canceled by the end of 2027 due to escalating costs, unclear business value, or inadequate risk controls, highlighting integration challenges with legacy logistics systems in 2025-2026.

- In 2026, one-third of retail marketplace projects (impacting logistics and e-commerce supply chains) will be deserted as agentic AI-driven answer engines steal traffic, forcing a shift toward unified agentic commerce experiences.

- By 2030, 50% of cross-functional supply chain management solutions will incorporate intelligent agents for autonomous ecosystem decisions, building on 2025-2026 pilots in logistics for tasks like dynamic warehousing and transportation rerouting.

- AI-driven growth in manufacturing and infrastructure, supporting logistics efficiency; US onshoring and tariffs may boost domestic chains by 5-10% while pressuring Europe.

- UPS’s €20B push into health-care logistics (cold-chain acquisitions in Europe) addresses shipping slowdowns, leveraging AI for multimodal optimization.

Generative AI

- GenAI Workforce Planning. In 2026, high-volume recruiting in talent acquisition will go AI-first, with GenAI streamlining supply chain talent needs amid worker shortages.

- AI Market Momentum. The overall AI market, including GenAI, is expected to reach around $244 billion in 2025 and grow beyond $800 billion by 2030, supporting logistics tech like route optimization and predictive maintenance.

- High-ROI GenAI Use Cases. GenAI use cases with the greatest ROI include content creation and supply chain optimization, accelerating processes for retail and consumer brands in 2026.

- Domain-Specific Adoption Gap. By 2027 (extending from 2026 trends), more than 50% of GenAI models will be domain-specific, but adoption in offices and supply chains may fall short of expectations due to flimsy demand.

- GenAI Use-Case Maturity. Progress in 2026 hinges on effective use cases for GenAI and agentic systems, including in digital commerce and supply chains for optimized fulfillment.

- AI-Mediated Workforce Balancing. In 2026, GenAI could help ease regional worker shortages and revive productivity growth in areas like New York, applicable to logistics hubs facing labor gaps.

- AI-Driven Air Mobility Planning. AI, including GenAI, enhances air mobility planning for global transport logistics, with tools transitioning to operations centers for streamlined processes in 2026.

- Mainstream GenAI Acceptance. From 2026, using GenAI in films won’t disqualify Oscar nominations, signaling broader cultural acceptance that could extend to creative logistics applications like design optimization.

Advanced Connectivity (5G/6G, Satellites, IoT)

Some countries face challenges balancing infrastructure demands and data privacy concerns. And the takeaway is that having real high-speed connectivity is a total game-changer when it comes to using AI to drive logistics, and 2026 is really going to be the year that it all starts to take off in a big way, towards more systems that are not only faster but also able to keep running through thick and thin.

- The number of IoT devices worldwide is forecast to more than double from 19.8 billion in 2025 to over 40.6 billion by 2034, with significant uptake in logistics for asset tracking and predictive maintenance, enabling AI-driven optimizations in supply chains.

- $122B average annually, greenfield to $360B (30% in South); US dominates sources, Europe/Eastern Europe sees restructuring to resilient chains.

- Frontier tech market to $16.4T by 2033 (AI $4.8T); US/Europe hold 2/3 patents, but divides risk; AI optimizes logistics (e.g., predictive disruptions, renewable management) with 14-56% efficiency gains.

- Innovations in 6G and LEO satellites could enhance supply chain resilience by 2026, particularly in US remote or disrupted logistics routes.

- In US-specific contexts, trends align with investments in sovereign infrastructure (e.g., domestic chip fabrication for IoT devices), positioning logistics for adaptive, transparent AI-driven operations, and potentially 10-20% efficiency gains in real-time tracking.

- ITU’s AI activities (e.g., UN reports/software) and broadband strategies mention supply chain impacts from 5G delays, but lack 2026 specifics.

Autonomous Technologies: Trucks, Drones, Vehicles

These statistics highlight autonomous technologies as a pivotal driver for logistics efficiency, with 2025-2026 focusing on pilots like driverless trucks and drone integrations to overcome legacy limitations. However, safety regulations, global competition, and integration risks could temper full-scale adoption. Firms should invest in partnerships for resilient, AI-enhanced fleets.

- Short-term adoption of autonomous vehicles is forecasted to be more robust in commercial logistics and transportation use cases beyond factories and warehouses by 2026, shifting from legacy manual fleets to AI-integrated systems.

- Reitar-NEXX alliance deploys Agentic AI in Qatar fulfillment (5K sqm center in 2025), with 3,800 items/hour sorting; expands to Europe post-2029, influencing US/EU cross-border chains via AMRs/WMS integration.

- By 2035, autonomous driving could generate $300 billion to $400 billion in revenue globally, with early 2026 pilots in logistics (e.g., self-driving trucks) laying the foundation for cost reductions and driver shortage solutions.

- Autonomous warehouses will merge with autonomous manufacturing and delivery by 2026, forming fully automated supply chains in the US, enabled by robots and drones for aggregation, storage, and last-mile logistics.

- Trends toward electric and autonomous vehicles are set to revolutionize the transportation and logistics industry by 2026, with firms piloting AI agents and autonomous systems for intelligent supply chains.

Real-Time Visibility

US-specific insights highlight investments in resilient networks, but global disruptions (e.g., tariffs) amplify the need for real-time tools.

- Real-time transportation visibility platforms (RTTVPs) provide location and status insights into orders and shipments, with the market evolving to include multimodal tracking.

- By 2026, supply chains are projected to become increasingly autonomous, leveraging real-time analytics for end-to-end efficiency, integrating visibility tools with AI for adaptive operations in logistics.

- The global supply chain management software market, including real-time visibility and analytics tools, is projected to grow with features like tracking shipments and inventory, supporting logistics transitions to AI-driven systems by 2030.

- In 2025, technology investments in digital logistics are gathering momentum, with over 250 global shippers emphasizing real-time visibility to reduce costs and improve control in supply chains.

- Visibility remains the biggest challenge for global supply chain executives, with 21.8% citing it in surveys.

Real-time satellite data, with the number of active satellites tripling in five years, offers competitive advantages in logistics analytics. Visibility into every layer of the supply network is essential by 2026, with real-time route optimization and end-to-end tools reshaping logistics for resiliency and efficiency.

Digital Twins and Simulation

Drawing from the best of the best — Gartner, McKinsey, HBR, news.mit.edu, The Economist, WSJ, Forrester, and Statista — here’s a collection of the most relevant statistics on digital twins and simulation in the context of shifting logistics technology from old-school systems over to AI-driven supply chains.

- Digital twins are being reimagined to simulate key strategy decisions in supply chains, helping logistics businesses navigate uncertainty by modeling disruptions and optimizing operations in real-time for 2026.

- In supply chains, digital twins optimize data inputs into management tools, generating predictive analytics to respond to scenarios, with early adopters in logistics seeing end-to-end growth potential scaling into 2026.

- The iChain super-agent, a simulation solution, enables predictive insights for smarter supply chain management, connecting data across logistics ecosystems with expected scaling in 2026 amid AI advancements.

- Simulation digital twins represent a $379 billion opportunity globally by 2034, with complex implementations in logistics starting to mature in 2026, offering non-transferable but high-value applications for firms.

- The top strategic technology trends for 2026 include interwoven AI-powered solutions, where digital twins and simulations enhance hyperconnected supply chains, positioning logistics as a leader in adoption.

- While digital twins offer predictive maintenance and fleet optimization in logistics, challenges like data silos and network issues persist, with opportunities for US carriers to leverage them for dynamic supply chains in 2026.

- The complexity and cost of simulation digital twins pose barriers, but they enable transferable value in logistics scenarios.

- Digital twins in everyday logistics, such as tracking networks, provide opportunities for efficiency but require addressing integration challenges with legacy systems in operations.

Cloud and Edge Computing

While some of the stats actually look ahead to 2026 and beyond, we’ve included them because they give a glimpse of what the future holds — like keeping track of packages in real-time, making decisions faster in warehouses and on the road, and most importantly, keeping data safe through thick and thin. We’ve pointed out where the bigger picture comes into play, whether that’s talking about using edge-enabled IoT to get a clearer picture of the supply chain or how the rapid growth of infrastructure is opening up new opportunities.

- We see edge computing playing a big role in getting autonomous systems up and running for last-mile delivery and navigation, all working together with AI to ditch the old, centralized systems by 2026 in favor of more distributed and resilient ones.

- Distributed cloud computing is key when it comes to keeping e-commerce logistics running smoothly during busy periods, while edge hardware itself is used for real-time analysis — like figuring out if damaged product pics are worth paying out on for claims in the supply chain.

- In the US, we’re looking at a 20-25% annual growth in data center demand all the way to 2030, with over $2.8 trillion in spending (which is more than 40% of the global $7 trillion) all going towards edge computing for IoT and 5G in logistics — like real-time monitoring.

- Surging compute demands from AI and robotics strain US infrastructure, with data center power demand adding 460 terawatt-hours by 2030 (tripling current levels), posing challenges for logistics firms reliant on edge for real-time supply chain operations.

- Water consumption by US data centers is projected to increase 170% by 2030, with examples like a large center using over one million gallons daily, creating resource bottlenecks for cloud-dependent logistics tech.

- Opportunities in modularity and federated governance allow logistics to manage AI supply chains, with 92% of companies planning increased AI investments, leveraging cloud and edge for autonomous tasks like shipping and fraud checks.

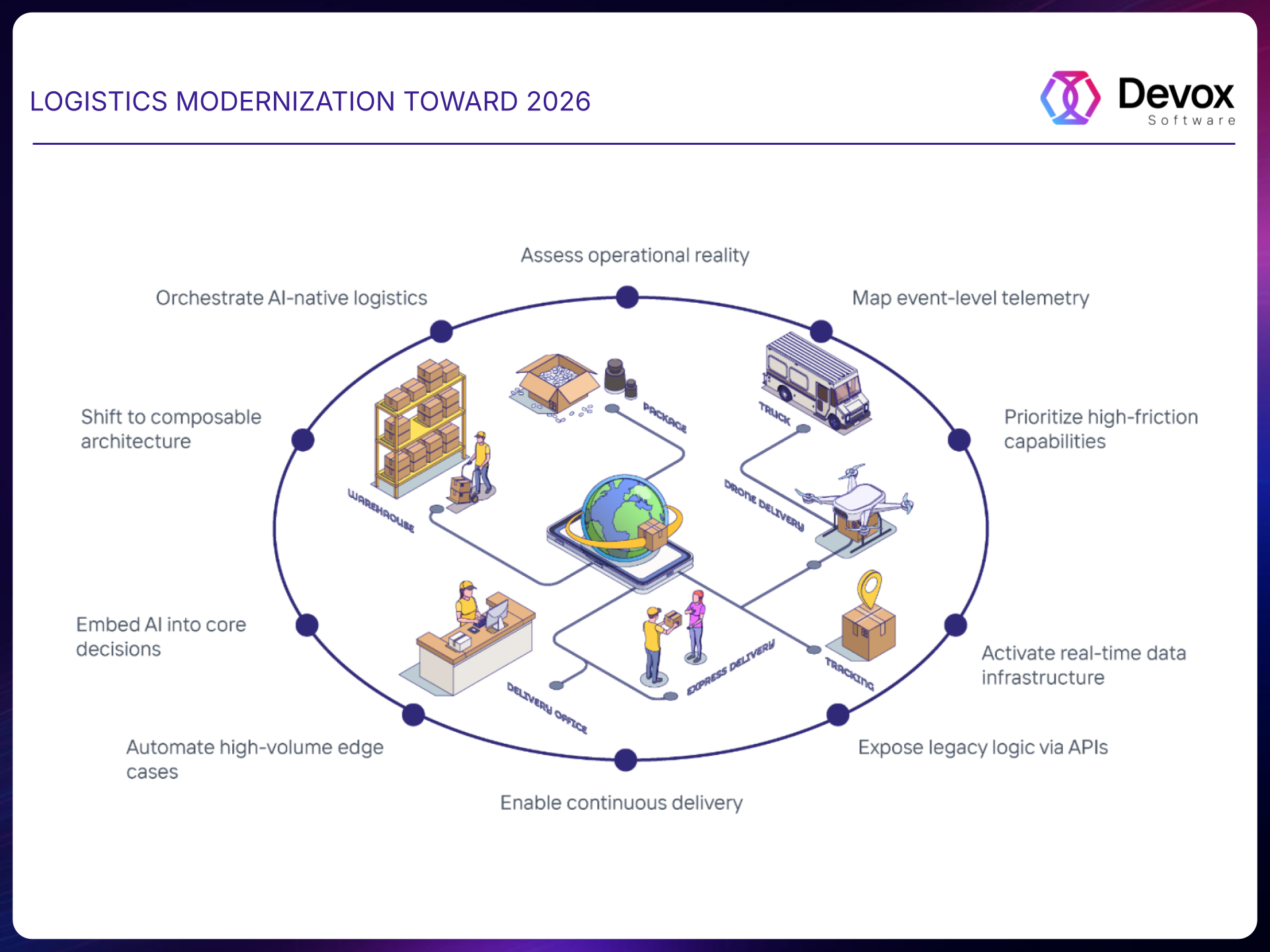

Strategy Road Map

Modern logistics transformation requires more than just new technology. It demands a controlled move from fragmented legacy systems to AI-driven supply chains — without disrupting live operations. This roadmap is a pragmatic path to modernization, balancing system stability with automation and AI execution.

Step 1. System Truthing

Get a precise end-to-end map of your logistics systems, integrations, and data flows. Identify stable operational zones, hidden dependencies, and areas where change introduces real production risk.

Step 2. Data Unification

Consolidate operational signals from TMS, WMS, ERP, IoT, and external partners into a single semantic layer. This creates a single source of operational truth and the foundation for AI-driven decisions.

Step 3. Logic Decoupling

Extract and modularize critical business logic from legacy cores. Preserve existing behavior while enabling incremental change, automation, and system extensibility without large-scale rewrites.

Step 4. AI Operationalization

Embed AI directly into logistics workflows: routing, inventory prioritization, exception handling, and disruption response, so insights translate into measurable operational actions.

Step 5. Governance Hardening

Introduce strict AI and data governance: model traceability, versioning, access controls, and compliance alignment. Ensure autonomous systems remain transparent, auditable, and controllable at scale.

Step 6. Continuous Evolution

Make continuous modernization an operating model. Deliver value in slices across locations, fleets, and regions while incrementally increasing system intelligence and resilience.