Table of content

In 2025, the battle for agility in the banking and finance sector happens in milliseconds.

Every delay costs twice: lost customers and missed signals. Speed now defines competitiveness: in onboarding, in compliance, in moving capital the instant it’s needed. Infrastructure maturity now determines how fast intent becomes execution, especially for price optimization software banking use cases.

Regulatory shifts, security demands, and customer needs change faster than legacy infrastructure can adapt. Modernization unlocks direct value: freed budget, faster launches, measurable resilience. CTOs who lead the shift from legacy core banking systems clear a path for business scale and new revenue streams.

This playbook outlines eight levers for technical velocity. Built for CTOs who engineer outcomes, measure impact, and lead from architecture up.

Modernization as a Profit Lever

Most banks don’t run on software — they run on archaeology.

Modernization creates space for invention. Every hour reclaimed from supporting legacy financial systems is invested in building new journeys and creating sharper experiences. The architecture shifts from barrier to launchpad.

“These systems often conflict with the needs of digital business models.”

— Maxwell Wessel, Aaron Levie & Robert Siegel in The Problem with Legacy Ecosystems (HBR)

Streaming payments and real-time fraud signals are transforming product teams, unlocking global scale and rapid merchant onboarding. At Devox Software, we’ve seen this firsthand: in one European banking platform, a simple backend refresh of legacy systems opened the door to velocity and expansion.

In a cloud-native, API-driven stack, product teams break the pattern of long sprints spent untangling the past. Every integration, every feature, every compliance update moves with the rhythm of the market, not the weight of old decisions.

Modernization amplifies collaboration. Developers, security leads, and business teams step into the same flow. Product ideas reach production faster. Customer feedback loops close quickly, creating a virtuous cycle of release and refinement.

For the CTO, this shift goes beyond technology. It signals a culture where the team builds for growth, where technology matches ambition, and innovation gains a clear runway. The shift creates not only capacity but rhythm. Teams deliver at the cadence of market signals, not infrastructure constraints. This evolution calls for architectural precision, guided by principles proven across transformation at scale.

Six Principles: The Architecture of Acceleration

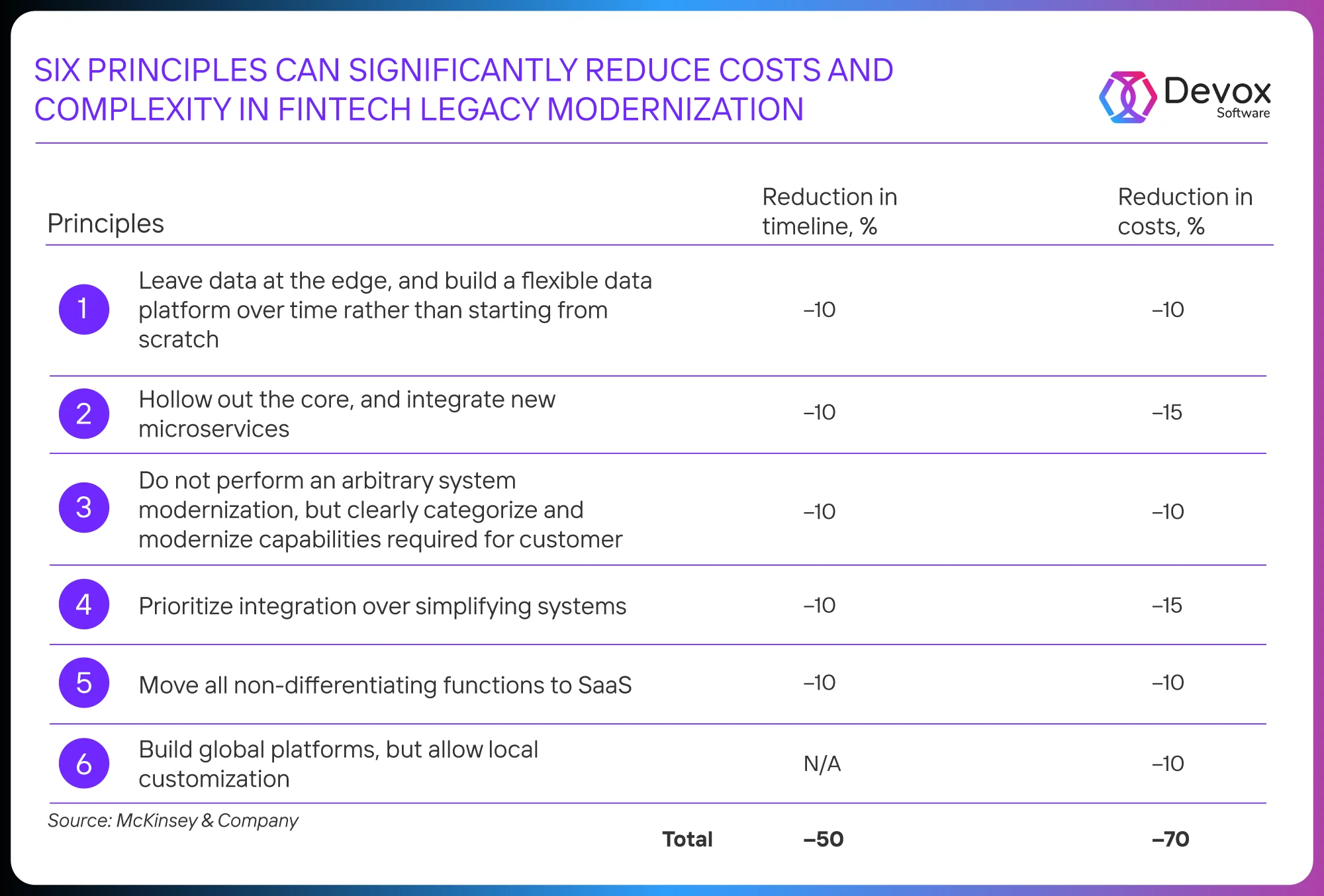

These six principles do not operate in theory. Each one converts a structural bottleneck into sustained delivery momentum, forming a blueprint for scalable execution.

According to McKinsey, successful legacy modernization follows six proven principles, distilled from more than fifty banking transformations. Each principle targets a specific barrier, unlocking new velocity and reducing complexity at scale.

- Data at the Edge. Data remains close to its source. Teams build flexible platforms incrementally. Each new interface unlocks real-time analytics, sharper insight, and faster decision cycles.

- Hollow Out the Core. Innovation starts at the edges. Core systems evolve by migrating essential logic into microservices, step by step. Every new module increases agility and shrinks the footprint of the past.

- Modernize What Matters. Modernization starts with business priorities. Every capability earns its place by supporting real customer journeys. Focus ensures resources drive measurable business outcomes.

- Integrate First, Simplify Second. Integration comes before simplification. API layers surface what delivers value, then teams decommission what holds them back. Clarity comes before clean-up.

- SaaS for the Non-Essential. Standard business functions migrate to SaaS, freeing in-house tech for differentiation. More bandwidth for growth, less friction for operations.

- Global Platforms, Local Value. Banks build on shared platforms, but keep freedom for local adaptation. One architecture powers many business models, especially in bank optimization retail software, where flexibility defines local success.

Each principle, confirmed by McKinsey’s global research, cuts friction, cost, and complexity. Together, they give CTOs a blueprint for modernization that scales with business ambition.

Decision Vectors for CTOs: Technical Depth

Principles define the direction. Execution requires depth. These seven technical vectors map architecture to operational leverage and create the lanes for compounding impact.

Every modernization path begins with a clear system inventory and dependency mapping. Advanced teams deploy automated discovery tools to map data flows, integration points, and shadow dependencies, revealing the real architecture beneath the diagrams.

Vector #1. Business-critical core first

Modernization focuses on high-frequency transaction platforms: core banking, payments, and customer onboarding. Here, replatforming means shifting from tightly coupled mainframes to modular, containerized microservices. Teams containerize legacy code with tools like Docker and OpenShift, wrapping mainframe logic in APIs. This enables progressive migration, where new services intercept requests, while legacy code still runs in parallel.

In one BNPL project, we carved a decade-old monolith into cloud-native microservices — without the lights flickering once. What changed? Loan approvals that dragged for seconds now flash green in under 300 milliseconds, reconciliations that took an hour clear before the first coffee, and the AWS bill dropped by a third. The merchants felt it instantly: fewer abandoned carts, faster payouts, and a system investors could trust to scale. That’s the magic of going straight for the core. See the case here

Vector #2. API-first Integration

Architects establish an enterprise API gateway (e.g., Kong, Apigee, or Azure API Management) as a mandatory entry point. Every legacy function is exposed as an API. Teams enforce JWT-based authentication, global rate limiting, and centralized logging from day one. This layer enables secure, auditable, and observable integration between new cloud services and legacy components.

Vector #3. Cloud-native foundation

The target state is a hybrid or multi-cloud architecture. Sensitive workloads stay on-premises or in private cloud (using Kubernetes clusters like AKS, EKS, or OpenShift). Customer-facing services and analytics move to public cloud, leveraging managed services (AWS RDS, Google BigQuery, Azure Cosmos DB). Infrastructure as Code (IaC) standardizes, audits, and replicates every environment.

Vector #4. CI/CD and DevOps:

All modernization projects run through continuous integration and delivery pipelines. Every microservice, API, and infrastructure change is versioned, tested, and promoted via automated pipelines (GitLab CI/CD, Jenkins, Azure DevOps). Deployment frequency increases, and rollback risk drops. Observability tools (Prometheus, Grafana, Datadog) monitor latency, error rates, and business KPIs in real time. Distributed tracing (OpenTelemetry, Jaeger) follows every customer journey across bank legacy systems and cloud for end-to-end performance insight.

Vector #5. Data migration and mesh

Teams avoid “big bang” data moves. Instead, they apply Change Data Capture (CDC) with Debezium or AWS DMS to sync legacy databases with new cloud-native stores. Golden source data sets are incrementally validated and surfaced through a flexible data mesh, ensuring that no business process loses fidelity during migration. In one project with tax-heavy legacy banking system, this meant that incremental CDC pipelines can clear the path. One SAP-driven finance org reached 99.9% filing success within weeks, thanks to schema-validated XML flows and real-time e-invoice sync to national portals.

Vector #6. Security and compliance

Every stage follows Zero Trust principles. Secrets rotate automatically via HashiCorp Vault or AWS Secrets Manager. Sensitive fields are encrypted in transit (TLS 1.3) and at rest (AES-256). Audit logs stream to a centralized SIEM for real-time threat detection and regulatory reporting.

In one of our PSD2-compliant projects, we implemented TLS 1.3, card tokenization, MFA, and AI-powered fraud detection, which reduced payment incidents by 15 percent without affecting transaction speed.

Vector #7. Early wins

Modernization delivers immediate value by moving non-differentiating workloads such as HR, procurement, analytics sandboxes to SaaS. This shift releases infrastructure, budget, and IT attention, setting a foundation for deeper modernization.

Business alignment: modernization rituals include business-led backlog grooming, cross-functional SRE reviews, and “showcase” demos for stakeholders. Every release delivers measurable impact: reduced latency, faster onboarding, new revenue channels.

From Legacy to Launchpad: Technology as the Growth Engine

In 2025, the real differentiator among financial institutions sits beneath the surface, coded into how quickly technology turns intent into execution.

Modernization replaces bottlenecks with building blocks.

Every core refactor releases operational headroom — a critical enabler for bank balance sheet optimization software to function with real-time accuracy. Migrating to composable microservices gives product teams the power to deliver, iterate, and scale at market speed. API-first infrastructure breaks the silos between legacy, cloud, and external partners. Suddenly, what took quarters takes weeks. What took dozens of specialists becomes automated, observable, and repeatable.

Cloud-native patterns amplify resilience.

Mission-critical workloads move to hybrid and multi-cloud architectures. Sensitive processes such as settlements, KYC, and regulatory reporting are anchored in private clusters for compliance. Customer-facing products and analytics flow to public clouds, leveraging elastic scale and managed services. Infrastructure-as-Code and container orchestration guarantee every environment matches spec, audit, and policy — no more snowflake servers, no hidden dependencies.

Data becomes a strategic asset, not just an operational necessity.

Legacy modernization puts data at the center. Golden sources surface through data mesh architectures. Real-time pipelines (CDC, streaming) ensure every insight, every compliance report, and every AI-driven trigger arrives with confidence and transparency. Teams stop spending cycles untangling data lineage and start delivering new value — predictive models, tailored offerings, and smarter fraud detection.

Security, privacy, and compliance become enablers, not afterthoughts.

Zero Trust models applied from the API gateway to the database embed protection into every layer. Encryption, tokenization, and automated secrets management reduce risk at scale. Centralized monitoring closes the loop: every API call, every anomaly, every compliance-relevant event is observable and actionable in real time.

Legacy often hides treasure. At a brokerage weighed down by spreadsheets, we built a trading bot that turned scattered Excel sheets into one sleek, live dashboard with automated execution. Overnight, what once meant hours of manual checks became instant, traceable trades guided by data and guardrails. The team stopped wrestling with errors and started chasing opportunities. That’s how modernization doesn’t just clean up the past — it writes new revenue into the future. Explore the case

DevOps and Observability reshape delivery culture.

Every application, service, and infrastructure change moves through automated CI/CD. Feature toggles, blue/green deployments, and canary releases minimize risk and shorten feedback loops. End-to-end tracing lets teams spot latency, bottlenecks, and emerging issues before customers notice. Teams measure velocity and reliability with the same rigor as revenue and margin.

Supporting this transformation, McKinsey notes a rise in immersive observability strategies that unify telemetry, logs, and traces into real-time dashboards. SRE teams are now using tools like Grafana and OpenTelemetry to diagnose performance shifts and trigger automated remediation — reinforcing the resilience of modernization efforts.

Business and IT operate as one team.

Backlogs prioritize business value: new customer journeys, embedded banking, partner APIs, and real-time dashboards. Stakeholders review progress in live demos. Compliance, security, and risk integrate into the release cycle, not layered on top. Technology becomes a growth multiplier, not a cost center.

Modernization is a continuous journey.

Banks that treat modernization as a one-time fix build in fragility. Leading CTOs create rhythms of constant reinvention, updating tools, evolving patterns, and benchmarking against market shifts. Every successful migration, every automated process, and every resilient release compound competitive advantage.

Outcomes compound.

Customer onboarding speeds up by an order of magnitude. New business lines launch with confidence, backed by scalable, secure platforms. Operational risks decrease — incidents drop, resolution times shrink, and audit cycles simplify. Teams shift from firefighting to delivering value. Every line of code adds momentum.

The ask for CTOs:

- Map your current architecture to these patterns.

- Identify the modernization levers with the greatest business impact.

- Organize migration waves around quick wins and critical risks.

- Align DevOps, business, and risk in one flow.

Build a culture that treats legacy not as a burden, but as the raw material for your next leap.

The banks leading in 2025 won’t have the newest logo or the flashiest app. They’ll have the deepest integration between business vision and technology execution. Legacy is simply tomorrow’s runway, if you have the discipline and ambition to refactor it, one release at a time.

Pillars of High-Velocity Modernization for CTOs

Pillar 1. Data Activated at the Edge

Modern platforms stream events in milliseconds and use self-healing AIOps to keep systems resilient and transparent. Kafka, Pulsar, and CDC pipelines like Debezium or AWS DMS feed always-fresh analytics, while a data-mesh model ensures each domain owns its golden sources. AIOps engines digest logs and traces, predict saturation, launch self-healing playbooks, and feed real-time dashboards for risk, product, and compliance leaders.

Pillar 2 Modular Microservices Ecosystem

Legacy COBOL modules stay alive behind an API façade while microservices bloom around them. Teams slice business capability into Spring Boot or .NET Core services, package with Docker, deploy on Kubernetes, each with its own GitLab CI pipeline, SLO, and circuit-breaker. The Strangler-Fig pattern retires obsolete routines sprint by sprint, so feature flow marches forward without weekend cutovers.

We applied this principle to several projects, including a US-based fintech platform, where we extracted individual modules from the monolith during each sprint, monitored their stability with AWS X-Ray, and deployed them using a blue-green strategy.

Pillar 3. Cloud as Business Accelerator

Hybrid topology anchors confidential ledgers inside OpenShift clusters; customer-facing journeys burst into AWS, Azure, or GCP for elastic scale. Terraform codifies every subnet, secret, and autoscaling rule. Managed gems (RDS, BigQuery, EventBridge) erase undifferentiated heavy lifting and free engineering focus for revenue engines. Multi-cloud placement hedges vendor risk and balances latency with regulatory boundaries.

Pillar 4. Observability and Resilience

Modern reliability engineering turns outages into rehearsed maneuvers, not surprises. OpenTelemetry, Prometheus, and Loki converge in Grafana to give full-system clarity, while SRE decks catch p99 latency shifts and trigger instant rollbacks with Argo Rollouts. Weekly chaos experiments prove services can degrade gracefully under burst traffic, patch cycles, and pod evictions.

Pillar 5. API-First Productization

Every capability ships behind a versioned, documented endpoint. Kong or Apigee gateways enforce OAuth2, rate contracts, and schema validation. API-monetization portals expose banking functions such as KYC, transfers, instant payouts to fintech allies and marketplace builders. Partner onboarding becomes minutes of key exchange instead of quarters of custom integration.

We built one of our latest white-label neobanking platforms following the API-first principle, moving all services, from KYC to currency transfers, to versioned APIs with full support for OAuth2 and rate limiting.

Pillar 6. AI-Driven Automation and Optimization

Generative-AI assistants read legacy copybooks, surface hidden rules, and emit clean Java or Go skeletons. ML models score fraud in real time, orchestrate credit decisions, and tune marketing offers on clickstream velocity. RPA bots lift payroll, reconciliation, and claims processing, cutting swivel-chair work. Predictive capacity planners spin up clusters before TikTok promos spike load.

Pillar 7. Security and Compliance by Design

Zero-Trust meshes verify every identity, device, and workload hop. TLS 1.3 wraps each handshake; AES-256 encrypts every block. HashiCorp Vault rotates secrets, while OPA policies guard against configuration drift across clusters. Real-time SIEM flows funnel into cloud-native WAFs and SOAR playbooks, yielding instant audit artifacts for every jurisdiction.

Pillar 8. Continuous Evolution and Delivery

Feature flags, blue-green lanes, and canary waves release changes with heartbeat regularity. DORA metrics ride alongside revenue dashboards, aligning engineering cadence with boardroom ambition. Wave-based migrations move core domains in controlled phases: observe, mirror, switch, and retire. Every cycle compounds speed, quality, and margin, turning yesterday’s legacy into tomorrow’s runway.

Executive Wrap-Up: Modernization as the Multiplier

Once these pillars are established, they begin to act not as projects but as systems. Modernization becomes a rhythm, measured in feature flow, incident latency, partner activation, and team velocity.

Modernization guided by these eight pillars helps banks turn legacy core banking systems into platforms that generate margin, speed, and flexibility. Compounded value comes from every refactored service, every automated deployment, and every secure data pipeline.

The economic importance of modernization is reinforced by workforce data: CompTIA estimates net tech employment in the U.S. will reach 9.9 million in 2025, with software development and cybersecurity roles growing over 2.5x faster than the national average. Banks accelerating their modernization strategies stand to attract this high-demand talent.

The table below turns strategy into movement. Each row links a modernization wave to a first-week action, core toolset, and a 90-day success signal. Choose a wave, assign twin owners, and track the metric every sprint:

| Modernization Wave | Primary Business Lift | Quick-Start Move (Week 1) | 90-Day Success Signal |

| Data Mesh Activation | Instant, domain-owned insight | Stand-up Kafka topic plus golden-source registry | Query latency falls below 200 ms |

| Microservice Extraction | Parallel feature flow, isolated risk | Wrap one COBOL function with Strangler API | Deploy frequency triples |

| Hybrid-Cloud Burst | Elastic scale with capex-to-opex shift | Lift analytics sandbox to public cloud | Cloud cost per transaction declines |

| Unified Observability | Fault discovery in minutes | Pipe OpenTelemetry traces into Grafana flight deck | MTTR cuts in half |

| API Marketplace Launch | New partner revenue stream | Publish KYC endpoint on Kong gateway | Partner API calls reach 10 k/day |

| AI-Driven Ops | Predictive risk and capacity | Feed six months of fraud logs into ML model | Fraud loss ratio drops ten percent |

| Zero-Trust Fabric | Continuous audit readiness | Enforce Vault secret rotation across clusters | Zero critical findings in audit |

| Continuous Delivery Rhythm | Release cadence aligned with board goals | Flip first feature flag via blue-green lane | Lead-time-for-change < 24 h |

In conclusion, every bank runs on choices made years ago. Each line of code written in a different era either drags or propels today’s ambitions. Modernization is the chance to release that weight and give teams a cleaner rhythm — one where systems accelerate product launches, compliance reports surface in real time, and engineers finally have the space to build with intent.

What starts as a technical refactor quickly becomes cultural. Delivery gains cadence. Ideas reach production in the same quarter they’re imagined. Business and technology stop competing for attention and start amplifying one another.

The institutions shaping 2025 will be remembered less for the polish of their apps and more for the tempo of their execution. Legacy doesn’t vanish; it transforms into the foundation for scale. The real differentiator is speed with substance — the ability to turn vision into market impact, release after release.

Frequently Asked Questions

-

What is a legacy payment system?

A tightly coupled, batch-driven engine, hardcoded for routing, risk logic, and static validation. Changes trigger full-stack regression, partner coordination, and downtime windows. There’s no versioned API, no dynamic flow. Every innovation stalls at integration.

-

What’s a legacy data system?

A siloed platform where lineage is unclear, batch pipelines lag, and schema changes ripple across multiple dependent systems — the hallmark of legacy systems in banking. Regulatory pressure demands traceability and real-time audit readiness. Legacy data becomes a risk when insight arrives after decisions are made.

-

How does a legacy system work?

It runs on accumulated logic: COBOL routines, shared memory locks, fixed field positions. Each function assumes global state. There’s no isolation, no modularity. A change in one area often means risk in five more. Velocity drops, error rates rise, ops enter a permanent firefight mode.

-

What are some modern concerns in the banking industry?

Three forces converge: customer latency tolerance shrinks to seconds, compliance scrutiny intensifies across jurisdictions, and fintechs scale with composable stacks. Banks run into architectural drag — systems that weren’t designed to respond at the pace of market volatility, embedded AI, or real-time liquidity shifts. Without structural modernization, innovation throttles at the core.

-

Why do banks still utilize legacy and mainframe systems?

Because they settle trillions, with uptime, integrity, and throughput no cloud-native can yet match. Core ledgers, batch settlement engines, and regulatory systems remain hardwired to mainframes. But each upgrade extends fragility. Modernization doesn’t start with a rip-and-replace. It begins with visibility, orchestration, and boundary control.

-

What blocks retail banks from modernizing core software?

Embedded logic, legacy integrations, and change-sensitive regulations hold the line. Core platforms process thousands of concurrent operations—loan approvals, settlement flows, KYC triggers—all hardwired across decades. Shifting even one function requires controlled decoupling, robust shadow environments, and multi-wave migration planning. Without architecture governance and domain-led ownership, velocity stalls before it begins.

-

Why do large banks continue investing in mainframe upgrades?

Mainframes still anchor high-throughput, high-stability workloads—settlements, batch processing, and real-time balances. They deliver unmatched IOPS, uptime, and transaction integrity at scale. Replacing them outright risks business continuity, so banks modernize incrementally: containerizing interfaces, exposing APIs, and optimizing mainframe ops with z/OS tooling. These upgrades extend lifespan while enabling gradual decoupling into cloud-native services.

-

What’s the fastest way to isolate and modernize one banking product?

Target the product’s integration boundary—where APIs, data flows, and UI meet core logic. Wrap legacy functions with an orchestration layer, expose them as services, then route traffic through a controlled proxy. This creates a shadow environment for new components to operate in parallel. Teams migrate feature by feature using the strangler pattern, keeping customer experience stable while modernizing delivery behind the scenes. For instance, on a BNPL stack under investor pressure, we started by isolating the credit engine. Once rebuilt as a stateless microservice, approvals dropped to under 300 ms, even under flash-sale spikes, without ever freezing live traffic.

-

How does balance sheet optimization link to tech architecture?

Bank balance sheet optimization software relies on accurate, real-time data from loans, deposits, liquidity, and risk exposure to enable dynamic decision-making. Legacy cores delay access with overnight batches and siloed ledgers. Modern architecture enables streaming pipelines, unified data layers, and AI models that run continuously on live inputs. With the right infrastructure, CFOs adjust positions dynamically: pricing, reserves, and funding mix align with market shifts in minutes, not days.

-

How can a bank maintain stability while modernizing its old infrastructure?

Stability comes from isolation, orchestration, and observability. Banks run new services in parallel, reroute traffic incrementally, and validate the results before switching. Shadow environments mirror production, while toggles and proxies control the load. Automated testing, rollback plans, and real-time monitoring reduce risk at every stage. The infrastructure evolves, but the core of business continuity remains fully intact.

-

What are the hidden costs of legacy systems in transaction-intensive products?

Outdated cores drive up costs through delay, duplication, and degradation. Each transaction runs through multiple layers of outdated logic, increasing computational load and manual effort. Integration teams maintain fragile connections while operations experience downtime and coordination overhead. Change cycles span multiple quarters, limiting responsiveness to changes in fees, exchange rates or fraud. These inefficiencies quietly accumulate until margins erode under volume.

-

When should banks choose SaaS over in-house core software?

SaaS is best suited for non-differentiating functions like HR, procurement, CRM, and financial planning, where speed, scalability, and compliance are built into the platform. These services absorb vendor upgrades, reduce maintenance, and free up teams to focus on value creation. Banks retain full control over sensitive areas such as payments, general ledgers and onboarding, while SaaS takes over the operational backbone without any burden.