Table of content

Here’s where the financial apps step in! They help you plan a budget and follow up on your expenses, taking finance management to a new level.

The world of financial apps development is tricky yet lucrative. It’s a good way for startups to pursue market share in a growing software field. Besides, making a budget app is a promising niche with many business opportunities.

For example, in the UK, 14% of people under 30 years use a budgeting app daily, and 10% at least once a month. In the USA, over 60% of citizens use money management apps more often than before the Covid-19 pandemic.

Do you want to create a budget app on your own? We can help!

In this article, Devox Software will share insights on how financial apps work and what are the pros and cons of building them. You’ll learn what personal finance features will be popular in 2023, how many costs you’ll need as a starting capital, and the best strategies to monetize a financial startup.

Market Overview of Financial Apps Development with Examples

A personal finance product is typically a winning idea. The business owners who opt for a fintech industry and yet don’t consider the budgeting apps are probably missing an exciting opportunity. Finance management is something people talk about and need help with.

Beyond a massive demand for financial apps, there’s a tendency for a growing investment towards fintech companies. If you’re still unsure how to build a personal finance app, take a look at the competitive market players and their prominent features:

- Mint: a web-based personal finance program with more than 20 million active users

- Buxfer Inc.: an online money-management software, that helps to create budgets, set bill reminders, and check financial forecasts

- Money Dashboard: except personal finance management, it provides market research services to other companies. Since the day of its foundation, this app has raised more than $17.91 million.

- Personal Capital Corporation: a finance tool helping to set the right budgeting goals; in 2020, the experts valued it at between $825 ml and $1 billion;

- Quicken Inc.: is a personal budgeting software, allowing users to manage expenses, create their monthly budgets, and set the goals for retirement

- You Need a Budget LLC: a personal finance app (iOS and Android version), offering a four-step guide to successful budgeting. YNAB has become a mainstream application because of its two podcasts and a YouTube channel.

Types of Personal Finance Apps

Making a budget app, you should choose between the following options:

Manual-entry app

Manual entries are tracking systems that can follow up with money flows (income and expenses). The user can’t link a bank account, which makes it uncomfortable because every time you need to use an app, you should input all the data.

A manual-entry app is good if the customer wants to analyze finances from time to time without making it a lifestyle. The app will allow you to plan purchases and create budgets, and it’s an easier option for web developers.

Linked app

The linked applications will need more time and effort. It includes the same features, but their functionality and flexibility are much higher. With the link application, a user can connect a bank account and process the data without repeated input automatically.

Understanding How Personal Finance Apps Work

Before diving into the development, consider the aspects you want to highlight in a future product. A personal finance web app, that cares about user’s financial health should focus on the following functions:

Income

After you link your bank accounts to a money management application, you can categorize income transactions by the following categories: Paycheck, Bonus, Cashback, Reimbursement, etc.

At the end of the payment period, the app will summarize the total income you received from all the sources.

Spending

You may track your expenses as you do with an income. In this case, you’ll see how much money goes for your basic needs, big purchases, and entertainment.

When analyzing spending for some time, you may try to rebuild some of the financial habits. Consider a 50/30/20 rule as an option. It is a budgeting framework, allowing 50% of your money to spend on your basic needs; 30% to go for hobbies, entertainment, or eating out; and 20% left for setting financial goals.

Savings

Once you’ve taken control of fixed and variable spending, it’s time to expand your financial perspective for future needs. For example, most apps have a direct deposit option, transferring a fixed percentage from your income to savings.

The other feature is cashback. You may even create a separate account to collect bonuses from every purchase.

Investing

When users want to start investing or already own a portfolio, they can upload it to a personal finance app. That way, they can rearrange an investment style, get precious advice from financial experts, and make sure money goes where it belongs.

Portfolio tracking is possible whether you invest actively or in between the options. The finance app shows asset allocations across all investment accounts so users can compare their rates to market benchmarks.

Protection

A money management app on Android or iOS doesn’t differ in security requirements. The best personal finance products have such tools as security scanning and multi-factor authentication to protect against the leakage of vulnerable data.

Main Features for Finance Apps in 2023

Managing finances on your own can be annoying: collecting receipts, calculating an income, and worrying about checks. Luckily, in the 21st century, this option has gone into oblivion, and you may create a budget completely stress-free.

But what’s the future for personal finance apps in 2023? What do people expect from them, and what to consider before making a budget app?

Visual Presentation

Make sure your product follows the best UX/UI practices to catch the eye of your consumer. Plain text won’t keep anybody engaged; include the charts and dashboards to simplify the statistics and data for users.

Security

Say no more — security is important. People will put their private data in it (such as full name, address, field of occupation, and, more importantly – bank accounts), so take care of a safe environment within an app.

Personalization

The financial apps development balances the market trends and user needs, which are not always alike. You cannot adjust the interface for every consumer (because, hopefully, you’ll have millions of them), but you can make it more personal.

At Devox Software, we know the challenges of mobile development: we can help you to gather a ready-to-go team of Android and iOS developers. Using top-notch technologies, we’ll manage to create a budget app on time.

Gamification

Gamification is one of the most effective techniques to increase engagement. Nowadays, financial service providers have started to shift from the “banking as a service” to the “banking as an experience” point of view.

This feature incorporates challenges, competitions, and bonuses into a non-gaming environment. It helps to present boring information in an interactive way.

Account Aggregation

This feature allows one to combine credit and debit cards, loans, and other types of accounts for one user. One of the options to collect this data is requesting at Open Financial Exchange, a data stream for exchanging information.

Monetizing Strategies for Making a Budget App

The revenue models vary, depending on the type of fintech company. The common mistake of startup founders is putting profits aside and focusing more on user acquisition.

However, you must be 100% confident in a business model, especially in times of crisis. So, don’t hesitate to ensure your idea brings money.

Take a look at the most popular payment sources that fintech software solutions rely on:

Users

The companies like Digit and MoneyLion are using this strategy. They start a monthly subscription after a 30-day trial period and partner with credit monitoring services to advance user options.

Third-party sellers

The most known example here is Mint. It shows a selection of relevant ads to the consumers and earns money right after they follow the recommendations. In addition, such apps sell space for ads to pop up on users’ screens.

Third-party recipients

When customers use a fintech app, they generate monetary and indirect value for other companies. The apps actively promoting this model are Mint and Chime. They earn money from interchange fees (IRF), paid by traders after customers use an app to purchase something on a third-party website.

Monetizing App with Ads

Here are a few useful tips to get you started:

- Banners: in headers, sidebars, or footers

- Rewards for reviewing the ads

- Gamified ads: for example, interactive commercials

Monetizing App without Ads

If you don’t want your customers to deal with pop-up advertisements, you may consider the following options:

- Fees for download in App Store or Google Play Market

- Premium subscription charges

- Affiliate marketing

- In-app purchases

Instruction to Making a Budgeting App Like Mint

If you’ve seen plenty examples, and you picked Mint (or Chime, or You Need a Budget), it’s your lucky day! We’ll share valuable insights on the development process, and the expertise Devox Software has in developing finance apps.

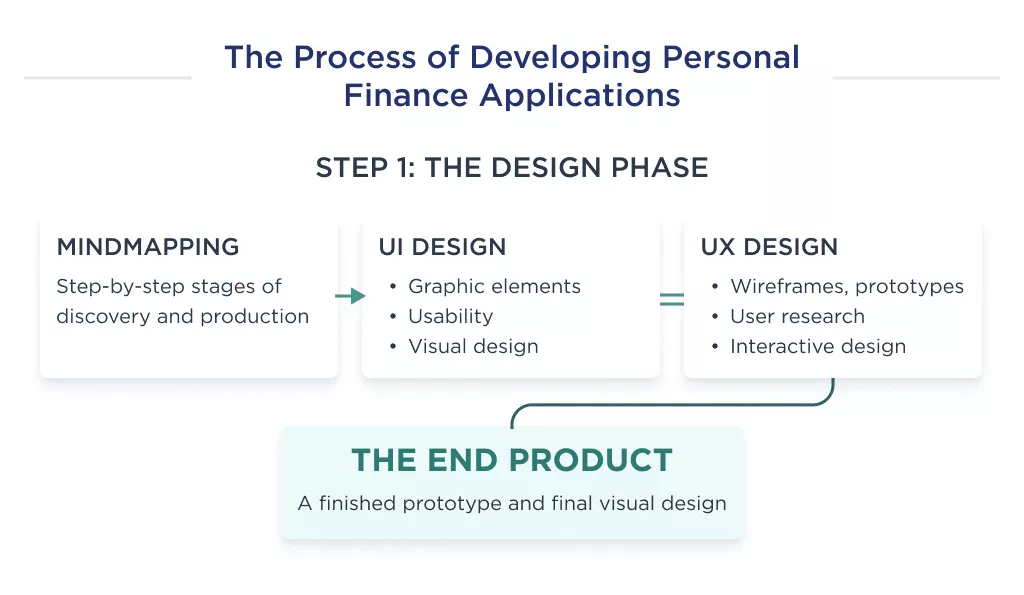

Step 1: Design

This is the first and vital stage in the development process. The outcome should include a prototype with specific details on user experience. This phase should not only focus on the aesthetic part but also on a smooth user interaction and engagement rate.

Here’s the list of three important factors during the design phase:

- Mind mapping: an illustration of the core app functions

- UX design: a complex process aimed to address the wider range of consumer needs

- UI design: a layout allowing the users to address all app’s features.

Step 2: Development

The software development team takes responsibility for incorporating all app features into an MVP version of the product. They need to make sure the app synchronizes with the payment accounts and provides real-time transaction tracking.

Step 3: Testing

When you’re making a budget app, this stage is critical to eliminate all the bugs and interact with the target audience. While the developers and QA engineers work on the tech side, you have to target future consumers and review the competitor apps.

As soon as MVP is approved, the developers can upgrade it with more customer-centric functions. If you started from a fully functioning app, you would need to evaluate its competitiveness from the beginning carefully.

What Else You Need: Dedicated team

If you want to create a budget app, you’ll require a professional team to take care of it. Let’s highlight the specialists needed for a successful project:

The optional roles include business analyst and DevOps engineer. You may consider them for more extensive market research and better management of the coding process.

Make Sure You Find a Reliable tech stack

A software development stage will need the right technical solutions, such as

- Laravel, NodeJS for the backend

- Kotlin for Android applications, Objective-C and Swift for iOS products

- SQL, XQuery, and QOL for databases, etc.

To comply with the FinTech rules, you’ll need to make a safe environment within a budget app. You may consider two-factor authentication or cryptographic algorithms to reach better consumer response and security.

The Costs Needed to Build a Personal Finance App

You won’t find a fixed price for making a budget app. You’ll find plenty of rates instead, but in the end, it will still depend on the number of features, the quality of the tech stack, and the specialists hired for the project.

Based on our experience, we can say that the average price for an initial MVP product, a ready-to-market option, and a custom finance application is different for every stage. Here’s the approximate costs needed to run a project:

| MVP Application | Standard Ready-to-Market Solution | Custom Application with Advanced features | ||

| Research Phase, Estimation & UX/UI Design | Hours | 95 | 140 | 265 |

| Cost, $ | $3 300 | $4 900 | $9 200 | |

| App Development:

– Product design – DevOps – R&D – Full SDLC |

Hours | 285 | 395 | 710 |

| Cost, $ | $10 800 | $15 000 | $26 900 | |

| QA Testing & App Launch | Hours | 170 | 270 | 495 |

| Cost, $ | $4 700 | $7 500 | $13 800 | |

| Total | Hours | 550 | 805 | 1470 |

| Cost, $ | $18 800 | $27 400 | $49 900 |

As you can see, the pricing gap is wide. Therefore, while you’re holding an idea of a personal budget app, it’s useful to determine your goals and align them with your financial expectations.

The Devox Software team will be happy to assist you. Contact us to calculate the costs of custom app development and pick a working engagement model. You won’t have to worry about hiring and managing a remote team: we’ll take care of everything!

Build a Personal Budget App: the Bottom Line

Personal finance is a great niche to immerse yourself in. It’s something people talk about, something they’d wish they knew better, and something they struggle with. The idea of a finance app is to put big expertise into an interactive software product, helping consumers ease their lives.

To create a budget app, you’ll have to understand its important features and monetizing strategies. Even if you have hard skills in development or design, it’s better to hire a reliable vendor, who’ve built hundreds of applications, than create it on your own.

Devox Software is a team of dedicated specialists ready to bring your idea to reality. We have experience developing applications for various purposes: a payment app, an online store, or a social wellness platform.

We have exceptional security and fintech professionals to ensure you’ll get the proper expertise for launching a successful product. Give us a call to get started!