Table of content

A consumer-lending segment is expected to reach $31.28 billion in 2022. However, modern lenders need flexible fintech products, and loan lending app development can provide such tools. Think about it: no lines, quick approval, and a chance to increase your credit score.

The tendency for mobile lending is easy to understand: people can register and apply for a loan from the comfort of their homes or while they work. They can upload passport scans to verify their profile, saving a lot of time on bank interactions.

So why wait? If your startup’s future is amongst financial pros, we’ve got some insights on how to create a money-lending app. At Devox Software, we know how to build a successful financial app. We’ll share the information you need, as well as an insider look at the development process.

But let’s explore how money-lending apps work in the first place.

The Reasons to Create a Lending App

One of the obvious benefits of money-lending apps is saving on operational costs. When you wonder how to create a loan app, think about reduced face-to-face interactions with customers or flexibility in routine procedures not linked to a physical location.

The other benefits are:

- Speeding up the KYC (Know Your Customer) procedures

- Serving more clients at once

- Reaching underserved markets

- Using AI to improve an end product

A money-lending app attracts individual borrowers who don’t want to deal with credit unions. After they sign up for a fintech product, they can set up their own conditions for interest rates and repayment terms.

Popular Money-Lending Apps and How They Work

Money-lending apps don’t only fulfill customer cash needs: most of them function as budgeting tools, checking accounts, and savings advisors.

The most popular products in 2022 are:

If you have an idea of how to create a money lending app, take a look at the basic steps for new users working with your product:

How to Create a Loan App: Let’s Start!

A loan lending app development has to satisfy the following customer needs: options variety, secure process, speed funding, etc. If people don’t find what they’re looking for, they will go to competitors. And you don’t want to lose prospective users.

So, where do we begin?

Register as an Entrepreneur

Start by registering your unique business name, following the government requirements. Thinking about how to create a money lending app, you can’t ignore the fact that your product should align with other businesses.

For example, if you register a startup in the USA, ensure your trademark is available at uspto.gov and follows the legal requirements.

UI/UX Design

People must feel comfortable using your software. It may have lots of features, but if it’s not intuitive, few people will stick with it.

So spend some time scrolling through available lending apps to see how their interfaces operate in real life. Try out the functions during common situations, like checking the balances or creating an account, and see how it all works out.

Software Development Options

You can build an app from scratch yourself (in this case, you’ll need both front-end and back-end developers to set up an interface) or order a development process on a turnkey basis. Consider you resources and business goals to make a choice.

After you’ve followed these preliminary steps, it’s time to explore the key features of money-lending apps!

The Features to Include in a Money-Lending App

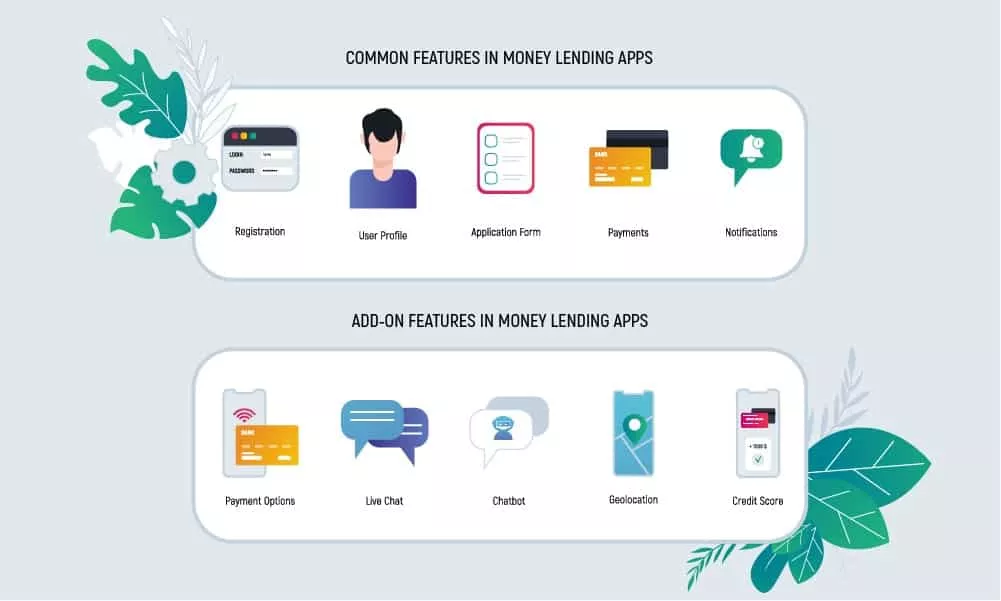

How to create a loan app? There are the basic features every fintech product should have and the optional features for the owner’s consideration. All of them ensure a smooth user experience and make an app more competitive.

Here are the options for you to consider:

- Common features:

- Registration: users should be able to login into the account using their email addresses or social media

- User Profile: including contact details and payment information

- Application Form: users can use it to request a loan

- Payments/billing: a money-lending app has to show the payment history to ensure transparency

- Notifications: for example, for overdraft protection or when the payment is due.

- Additional features are highlighted below:

- Different payment options

- Live chat

- Chatbot

- Location

- Credit history

Additional features are the ones you may or may not include, but they can help to get more loyal customers. In a multi-tasking world, good customer service is the key to all doors: in this case, a live chat is a great idea for improving your customer relationships.

Same with a credit score, which is a great analytical tool for your customer’s financial health. Depending on product strategy, you may include budgeting, educational, and savings features to expand your area of operations and make users’ lives easier.

6 Steps of a Loan Lending App Development

Before you dive into a mobile development process, make sure to learn about your target audience and discuss the features to be implemented in an MVP version. Once you’re done, gather your team members and create a project roadmap.

Step 1. Open a Test Case

After you’ve studied a target audience and familiarized yourself with law regulations, it’s time to think about functionality and scalability.

Before you go to the development stage, conduct market research and get to know your future customers. This way, you’ll be able to create a working strategy and easily attract new users.

You have to find out what apps are popular now, what they offer, and what users’ opinions are. Work closely with a business analyst to pick the most valuable features for the final product.

Step 2. Choose a Tech Stack

The most popular platforms for mobile applications are:

- iOS: Objective-C and Swift

- Android: Kotlin and Java

Devox Software has profound expertise in mobile and web development. We worked for eCommerce and FinTech industries, implementing customized features to ensure product success.

Step 3. Hire Dedicated Team

The options here are paying a fixed price or covering hourly rates until the product is ready, depending on what your strategy is.

To complete your money-lending app on time and with as few bugs as possible, you’ll need the following professionals:

- Project managers

- UI/UX designers

- Front-end and back-end developers

- iOS and Android developers

- QA specialists

We know that hiring requires time and experience. That’s why Devox Software professionals are ready to step in and find committed team members to make your business idea come true.

Step 4. Create an MVP Version

MVP (Minimum Viable Product) is a test version in loan lending app development that helps to validate customer expectations before releasing a fully-featured app. MVP should promote the product functions and make it easy for early customers to evaluate its functionality.

Before entering this stage, you need to have high-fidelity mockups and low-fidelity wireframes to test each screen and make sure your app is user-friendly. After UX/UI is complete, a software engineer creates a trial version with as many essential features as possible.

At this stage, you will understand what’s working well and what modifications you should make. If the MVP launch is successful, you can release a final product and start making money. If it receives plenty of negative feedback, you’ll need to go back and change the core app parts.

Step 5. Run Tests on Your App

You need to think not only about how to create a money-lending app but also about how to test it. Some of the testing methods in app development include:

- Automation: to measure app efficiency

- Security: to protect personal data

- Integration: to see how software can store, validate, and exchange data

- Functionality: to ensure seamless work of account opening, deposit process, etc

- Performance: to see how a product works under excessive load.

Step 6. Launch and Maintenance

Congratulations! If you’ve made it to this stage, you’re ready to launch a money-lending app!

The last step is essential for the startup’s existence and profitability. You’ll need a fully-dedicated development team able to make adjustments when the need arises. Besides, the team members should be instructed to handle operational complaints from users.

After the tech side of things is done, you have to tell more people about the product and its features. You may do it through social media (Instagram, Tiktok — feel free to choose your platform), content marketing, or a landing page.

The Costs Involved in a Loan Lending App Development

The amount you’ll need as a starting capital varies, depending on app features and functionality systems. It may start from $22,000 to more than $60,000. Take a look at the precise pricing below:

| MVP Application | Standard Ready-to-Market Solution | Custom Application with Advanced features | ||

| Research Phase, Estimation & UX/UI Design | Hours | 115 | 170 | 320 |

| Cost, $ | $4 000 | $5 900 | $11 200 | |

| App Development:

– Product design – DevOps – R&D – Full SDLC |

Hours | 330 | 460 | 825 |

| Cost, $ | $12 500 | $17 400 | $31 300 | |

| QA Testing & App Launch | Hours | 195 | 310 | 570 |

| Cost, $ | $5 400 | $8 600 | $15 900 | |

| Total | Hours | 640 | 940 | 1715 |

| Cost, $ | $21 900 | $31 900 | $58 400 |

The costs also depend on the team members and the expertise they have, the number of projects they worked on, their hourly rates, and the complexity of app functionality and features.

The app release stage is not the last on your expenses: after more users access your product, they will leave feedback and expect you to act upon it. To be sure your app will be a hit, you have to listen to your consumers.

Devox Software can calculate the project costs to align with your budget. We’ll go step-by-step, ensuring the prototyping and MVP version match the requirements (prior to custom app development if needed). Contact us to get a quote.

Create a Loan App: Key Takeaways

Money-lending apps are pretty straightforward: users create accounts, link their bank credentials, and request loans. They can choose a lender with the best interest rate and suitable repayment terms.

What customers need first is security. They trust an app with their private data and expect it will secure it from scammers. Besides, users need to be sure the app is reliable enough to fix their financial troubles.

If you’re an existing business owner or have a startup idea, you might think of a fintech app development as a piece of cake. How to create a loan app? Learn about the target audience, study and implement the features, and simulate the user experience to make sure the operations run smoothly. But don’t forget about a clear strategy and a project roadmap on your way to a successful launch.

Working with a reliable technology partner will make this process much easier for you. Reach out to Devox Software to take care of your project. We have a big experience in fintech app development and know how to find a good team, manage deadlines, and deliver a high-quality product. We’ll sort things out for your business in no time.