Table of content

By 2025, it will take one click or tap to pay. However, the underlying technology is still far from straightforward. Today, to design a payment system architecture, you need more than enabling transactions. Your payment system needs to be secure, scalable, and fast enough to meet modern user expectations and regulatory requirements.

This material is based on our best practices and guides through payment gateway architecture, checklists for creation, and tips. Ready to delve into payment system architecture? Let’s start.

Defining the Payment Gateway

A payment gateway is an essential element of a contemporary online business. It facilitates the real-time authorization and transfer of payments. Behind it, there is the technology that collects, encrypts, and sends sensitive payment information from the consumer to the payment processor or acquirer, like bank account information, wallet tokens, or credit card numbers.

Payment gateways reside on a variety of consumer touchpoints, such as websites, mobile applications, and POS terminals in physical retail locations, powering hosted payment pages, checkout forms, and JavaScript-based integrations on websites. Native SDKs help to integrate payment gateways in mobile apps, frequently improved with biometric authentication and support for digital wallets such as Apple Pay and Google Pay.

A payment gateway has two main functions: backend and customer-facing. It handles UI/UX components, verifies user input, and checks for fraud in real time. Moreover, it manages system logging, transaction routing, settlement, and encryption behind the scenes.

Furthermore, the architecture of payment gateway also supplies advanced features, such as tokenization and card vaulting for safe payment data storage, multi-currency handling for international trade, recurring payments for subscription models, and intelligent routing to several processors.

Generally speaking, payment gateways help to increase authorization rates and lower transaction costs. However, these are not the only advantages.

Benefits of a Custom Payment Gateway in 2025

With so many gateways already available, why create your own? What you get from custom architecture is a long list. But shortly, a custom payment gateway in 2025 will benefit you with the following:

- Lower Fees: No third-party commissions,

- Complete Control: You can customize features and user experience to your liking,

- Multi-Currency Support: Unrestricted worldwide expansion,

- Profitability: You are making money off of your financial resources,

- Improved Conversion Rates: Sales are destroyed by a cumbersome or sluggish checkout process.

- Deeper User Trust: Security failures cause churn.

- Revenue Scalability: Support for multiple payments and subscriptions is essential.

- Reputation: Loyalty is increased by smooth payments.

Despite numerous pros, payment gateways hide minor cons. Let’s break them down.

Challenges of Custom Payment Gateway Development

In practice, it is more difficult than it sounds. The businesses may face the following obstacles:

- High Initial Expenses: Hiring, compliance, integrations, and infrastructure — all require significant financial investments,

- Longer Time to Market: An MVP ready for production should be expected in 6–12 months,

- Security and Compliance: Non-negotiables include PCI DSS, PSD2, KYC, and AML, which can be challenging to comply with from scratch.

Now, it’s time to consider the elements of the payment gateway architecture.

Key Elements of Payment Gateway Architecture

At its core, a modern payment gateway must support the following features for security and performance.

Tokenization

The idea of tokenization is that it substitutes a distinct, non-sensitive identification (or token) that has no exploitable value in the event of a breach for sensitive card data (such as a 16-digit PAN). As a result, transactions become less risky. While the actual card information is securely stored in a PCI-compliant vault, this token is saved and used for future transactions.

To sum up, mobile wallets, one-click checkouts, and recurring billing all depend on tokenization, which reduces risk and presents the scope for PCI DSS compliance.

Strong Authentication (SCA, MFA)

Multi-Factor Authentication (MFA) and Strong Customer Authentication (SCA), which are required by PSD2, help to confirm user identity via a minimum of two of the following:

- Something you are familiar with, like your PIN or password,

- Something you own, like a hardware token or smartphone,

- Something that identifies you, like your fingerprints or Face ID.

In order to combat fraud and comply with regulations, modern gateways incorporate SCA through 3D Secure 2.0, push notifications, or biometric verification.

Real-Time Risk Scoring

To assign a risk score to each transaction, real-time fraud detection algorithms examine dozens, if not hundreds, of data points, such as device fingerprint, geolocation, transaction velocity, and user behavior. Transactions that surpass a predetermined threshold could be rejected automatically or put for further verification. That’s why modern payment system architecture now comes bundled with AI and machine learning algorithms that are constantly adjusting to changing fraud trends.

APIs

Payment gateways need to provide RESTful, well-documented APIs that let companies:

- Start transactions,

- Control tokens and users,

- Respond to chargebacks and refunds,

- Connect to CRM or order management systems.

For a quicker integration time, modern APIs provide SDKs for widely used platforms (JavaScript, iOS, Android, Python, etc.), are versioned, and provide webhooks for status updates.

Failover Mechanisms

Downtime results in financial losses. That’s why leading gateways use the following to guarantee 99.99%+ uptime:

- Traffic is distributed using load balancers,

- Geographically redundant data centers,

- When a primary node fails, automatic switchover to backup services or secondary processors occurs,

- Health checks to quickly reroute around malfunctioning parts.

All these taken together ensure a flawless experience even in the event of traffic surges, hacks, or outages.

Monitoring for Transaction Health

Real-time tracking of transaction metrics is required by payment platforms, including:

- Rates of approval,

- Reasons for declines,

- Codes for latency errors,

- Signs of fraud.

This empowers fraud and DevOps teams to proactively spot bottlenecks, keep an eye on questionable trends, and move fast to resolve problems. Numerous gateways offer a dashboard or make this data available through analytics APIs or outside observability tools (such as Prometheus or Datadog).

Let’s consider now how payment systems work in 2025, and if anything has changed.

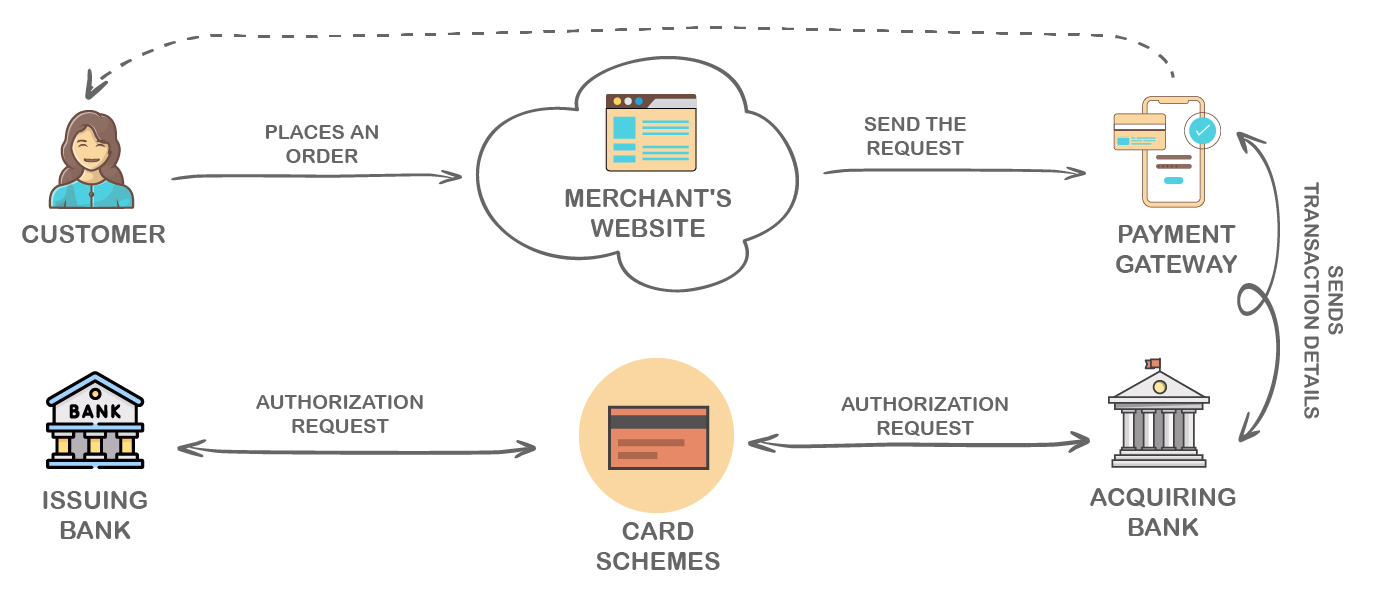

How Payment Systems Work Behind the Scenes

A brief overview of the transaction lifecycle includes:

- Request for Authorization: The gateway encrypts and transmits payment information to the processor.

- Fraud Screening: Suspicious activity is flagged by the risk engine. Funds are verified and retained upon issuing bank approval.

- Clearing and Settlement: Funds are transferred between accounts.

- Receipt & Notification: The user receives confirmation.

In general, the transaction lifecycle is much smarter and safer than it was in 2022. While biometric-backed authentication (via 3D Secure 2.2) guarantees compliance without creating additional hassle, payment authorization now incorporates a real-time AI-powered fraud score even before submission.

Gateways choose the best processor based on real-time data, such as fees and acceptance rates, using dynamic smart routing. As instant payment rails like FedNow and SEPA Instant become more widely used, clearing and settlement are frequently carried out in real time as opposed to batch cycles. More use cases, such as digital wallets and A2A transactions, are now covered by tokenization. Even with these improvements, the goal is still to finish the entire transaction in less than three seconds.

Payment Gateway Types in 2025

We smoothly proceed to another section to uncover the major payment payment systems’ architecture types in 2025:

- Distributed Architecture Gateways: These cloud-native, microservice-based gateways facilitate regional failover, auto-scaling, and high availability. The examples include Adyen and Checkout.com.

- Security-First Gateways: These place a strong emphasis on preventing fraud through integrated regulatory compliance and anomaly detection driven by AI. For instance, Sift, Forter, and Stripe Radar.

- Subscription Payment Systems: These systems manage recurring invoicing, unsuccessful payment attempts, and adjustable subscription tiers and are utilized by platforms like as Spotify, Notion, and Figma.

- SOA-Based Payment Architecture: Integration across the banking, fintech, and retail sectors is made possible by SOA-style payment systems, which are API-first and legacy-friendly, for instance, enterprise-class payment processors such as Worldline or ACI Worldwide.

They are so different. So, how to choose a proper payment hub architecture?

What to Consider When Choosing a Payment System Architecture

While choosing a payment system architecture, consider the following factors:

- Security & Compliance: The architecture must support PCI DSS Level 1, PSD2, 3D Secure 2.0, and local data residency laws.

- Integration Flexibility: RESTful APIs, SDKs, and plugins are crucial for platforms like Shopify, WooCommerce, and Salesforce.

- Speed of Payouts: T+1 (next-day settlement) or real-time rails like RTP/SEPA Instant.

- Global Coverage: Support for region-specific methods (e.g., iDEAL, UPI, Pix).

- Scalability: The architecture must be designed to handle peak loads (e.g., Black Friday or streaming spikes).

In the end, the ideal payment system architecture should not only satisfy the technical and legal requirements of today but also evolve with your business, adjusting to changing client demands, and ensuring that every transaction is quick, safe, and future-proof.

5 Steps to Integrate a Payment Gateway

There is a diagram, describing five crucial stages to guarantee a seamless and easy implementation of integrating a payment gateway architecture, which is a crucial step in enabling secure transactions. The full material you can read in “How To Integrate A Payment Gateway Into A Website.”

- Choose the Right Gateway: Take into account the transaction volume, location, and business type.

- Set Up API Credentials: Use sandbox tests, then switch to live.

- Implement Payment UI: Apply web, mobile, or headless checkout.

- Add Webhooks: For real-time transaction status.

- Test Edge Cases: Include Fraud attempts, chargebacks, and currency mismatches.

These procedures will guarantee that your payment gateway is completely connected, safe, and optimized to provide a seamless experience for your clients and your company.

Final Thoughts

In 2025, control, adaptability, and trust are key to performing payment transactions and designing a payment system. There are significant benefits to building your custom gateway, but only if you do it strategically and with the right partner.

Devox Software is here to be your payment architect and create solutions for your company that are future-ready, scalable, and compliant. Get in touch with us right now to plan your development.

Frequently Asked Questions

-

What is the difference between a payment gateway and a payment processor?

A payment gateway system design serves as a secure link between your website and the payment processor, capturing and encrypting consumer payment information. After that, the payment processing architecture handles authorization, settlement, and data transmission to the customer’s bank.

-

Is it better to use a third-party payment gateway or build a custom one?

If speed to market and unconventional compliance are your top priorities, a third-party system design payment system such as Stripe or Adyen is perfect. But in the long run, a custom gateway in payment system design is beneficial, particularly for fintech, SaaS, or high-volume platforms, if you require complete control over payments system design, reduced fees, or wish to integrate finance firmly into your product.

-

What compliance standards should a payment system follow in 2025?

In general, the compliance standards are contained in the following regulations for design payment system:

- PCI DSS Level 1 (data security) is the minimum requirement for payments architecture.

- SCA + PSD2 (Europe)

- KYC/AML (anti-fraud and identity)

- Local data residency legislation or the GDPR

- Additional certifications like SOC 2 or ISO/IEC 27001 can be necessary for enterprise or cross-border use cases.

-

How long does it take to build a custom payment system?

A completely functional, scalable pay system design system might take 9 to 12 months, whereas a minimal viable product (MVP) could take 4 to 6 months. This covers testing, UI, integrations, payment architecture design, and compliance.