Table of content

The concept of neobanking emerged in 2013-2015 years with the first digital-only services in the United Kingdom. Nowadays, one of the most famous UK neobanks is Monzo, with its 4% market share in terms of accounts.

Devox Software has been a pioneer in developing software products. If you have a startup idea or want to switch your fintech company to neobank, we can help! We apply the security best practices and hire skilled professionals to make your ambitions come true.

In this guide, we will discuss what neobank is, how do neobanks make money, and why you should switch your fintech provider to neobank. Let’s get started!

Defining Neobank

Neobank is a type of financial service provider that doesn’t have any physical branches. The neobank definition implies its expertise in online banking only, breaking traditional bank structure.

The most popular neobanks are:

- Chime

- Varo

- Ally

- Betterment

- Revolut

- Monzo

- SoFi

Neobanks meet most of the everyday consumer needs, including

- Payments

- Debit cards

- Money transfers

- Lending

Besides, most the neobanks include free educational tools that help consumers to plan their budgets.

In terms of business models, neobanks often collaborate with other financial institutions, providing them with a mobile/web interface. Alternatively, they can obtain a digital banking license and operate independently.

How Neobanks Differ from Online Banks

If you’ve been wondering what is neobank and how it differs from your banking app, you came to the right place. The obvious point is that online banking is an offshoot of a traditional bank with its physical location, while neobank doesn’t go beyond internet space.

A neobank often leverages Artificial Intelligence (AI) to make a smooth and enjoyable consumer experience. It’s more accessible for customers and, compared to digital banking, doesn’t need your physical presence to open a bank account.

The Ways to Make Money for Neobank

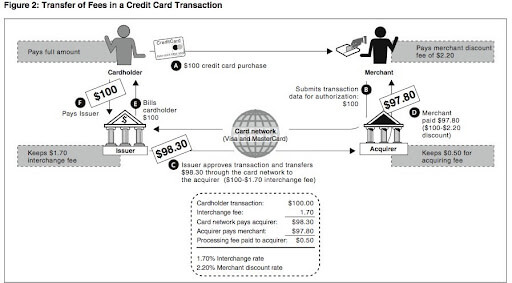

The primary money source for neobanks is interchange fees, particularly from debit cards. Therefore, these apps earn money whenever a customer swipes a card at a retail store or uses payment credentials to book a hotel room.

Out-of-Network ATMs

Neobank can profit when you use an ATM that’s outside of your bank network. For example, the average ATM fee reached $3.08 in 2021 worldwide. It’s a price you pay when withdrawing money from a different card, not the one ATM is for.

Interest Charges on Savings Accounts

The interest rate for the neobank savings account varies from 0.5% to 2.5%. It means that neobanks still charge fees for opening a savings account, being nevertheless more appealing to technologically-driven consumers.

Step-by-Step Guide on Starting a Neobank

To create an exceptional product, you must be aware of industry trends. Not only what is a neobank, and how they operate but also what your customers’ expectations are.

So, here’s a brief instruction to engage you in a process:

1. Development Stage

a) Come up with a marketing strategy

Dig into product discovery and research the latest tech trends for neobanks. Don’t ignore the competitors: by studying their features and possible weak spots, you can build an improved solution.

b) Create a UX prototype

Go through a UX process that involves the following five steps:

- Stakeholder interviews

- Product research

- Creating user stories

- Matching user experience with the design specification

- Conducting surveys and analytics

c) Build a UI design

To build a solid UI design, you have to embrace aesthetics and interaction. Be attentive to an interface: it should be both easy to use and visually appealing.

2. Testing and Development Stage

At this stage, you have to check if you’ve built the correct product logic and if everything suits clients’ needs.

a) Induce a development life cycle

The main aim of a development life cycle is turning your design into a working product. It has several stages, outlined below:

b) Launch your product

When you’re all set from a technical point, it’s time for the world to see your masterpiece!

c) Get the user’s feedback

Once you managed to create and present your neobank, be ready to collect user feedback. It may be a brief survey highlighting the benefits and weak spots of an app. Honest feedback can provide you with additional insights for improvement.

Fintech app development is quite costly. Therefore, figuring out how to make money is essential for neobank to strive. At Devox Software, we have a skilled development team with experience in creating banking applications.

As a top software development agency in Ukraine, we have already made successful business solutions for the eCommerce, financial, and healthcare industries. Our project managers will help you calculate the budget, avoiding unnecessary expenses. Besides, we’ll take care of skilled team members to ensure you get a quality product.

Neobank: Definition of Strong and Weak Spots

Before entering the market, fintech products have to earn their place under the sun. Therefore, clients of the traditional banking system may ask, “Why should I consider neobank for financial operations?”

Let’s take a closer look at the pros and cons!

10 Most Popular Neobanks

The number of neobanks is rapidly growing. Some of the banking systems already have millions of dedicated customers. Let’s take a look at the biggest neobanks and their prominent features!

Chime

A great choice for committing basic banking procedures. In 2021, Chime had nearly 12 million users; alongside online banking free of charge, it offers a $200 overdraft and access to 60,000 ATMs.

Lili

Lili is a neobank for small businesses and freelancers who want to track their finances. It has a Business Credit Card option and can assist you with accounting and taxes.

Revolut

Revolut offers GBP and EUR bank accounts, currency exchange, and peer-to-peer payments. Its mobile app supports withdrawals in 120 currencies worldwide.

Aspiration

A good option for the non-wealthy and socially conscious, Aspiration promises its users with a steady cash management service.

Statrys

Statrys is a neobank from Hong Kong, supporting multi-currency and providing trade finance services. Statrys is one of APAC’s go-to SME business accounts; it’s a solid competition in contrast to traditional banks.

Cleo

Cleo is a neobank combining financial technology with artificial intelligence. It’s a digital assistant that offers plenty of money management features (such as budget planning, setting saving goals, and improving a credit score).

N26

N26 is a German neobank with eight million customers across 24 different countries. This neobank offers a free basic account and a debit Mastercard to comply with the customer’s daily needs.

Current

Current is a type of challenger bank targeting young users. It helps customers to track their money in real-time, without boring numbers. Current is perfect for teenagers, as it has valuable information on money management techniques.

Starling Bank

This fast-growing neobank offers diversified services, like lending products and B2B banking. The users of Starling Bank can send international payments and enjoy 24/7 customer support from any part of the world.

Varo

Varo is a US-based neobank, that emphasizes no-fee services. In 2020, it was the first US consumer fintech to receive a national bank charter. The original Varo Money, founded in 2015, was among the pioneers in the account features for neobanks.

What to Know Before You Switch to Neobank

Neobanks are convenient for daily tasks: people use them to open a savings account or make peer-to-peer payments. However, neobank is not for everyone.

Firstly, because they offer only basic services. They don’t have many tools to handle complex transactions and rarely provide brick-and-mortar branches.

Here’s what you should ask yourself before opening an account on neobank:

- Do I care that it’s not a bank?

- Does it have any “fine-print” fees?

- Will I satisfy my needs with mobile banking only?

- What customer support channels do I prefer?

- What ATMs are accessible to me nearby?

- Can this neobank improve my banking experience?

- What do other users say about it?

Neobank is an environmentally friendly alternative to traditional banking systems. If you’re tech-savvy and utilize online banking apps easily, then switching to neobanks might be a suitable option.

Consider Neobank Now: Summary of the Main Points

Neobank is not a new concept for financial services. Many traditional banks have online versions, allowing them to conduct the basic procedures. But the main difference between neobank and regular banks is their flexibility and convenience.

Neobanks can expand your business opportunities. You can attract potential customers from around the world without getting attached to a specific physical location. Neobank will save time and increase your flexibility.

When you decide to switch to neobank or build an app for mobile banking, Devox Software can help. We’ll review the company values and the target customers to build the winning marketing strategy for a product.

With strong technical support from our side, you’ll be able to create next-gen bank applications, that will make a difference in the industry. Contact us to build future-proof solutions for your business growth today!