Table of content

We asked the questions that get to the heart of the challenges and ambitions of today’s fintech leaders. From the struggle to balance regulatory requirements and innovation to the quiet revolution of artificial intelligence, the insights gathered paint a vivid picture of an industry on the cusp of the next big leap.

This is not just data, but a snapshot of the future, told by those who are shaping it. And as we piece together these insights, one thing is clear: the companies that succeed in this environment aren’t just adapting — they’re rewriting the playbook.

The key findings at a glance:

- 72% of executives believe that adopting AI, RPA and blockchain is no longer optional — it’s critical to staying competitive.

- 71% say customer-centric innovation is the driving force for long-term growth

- 52% cite regulatory compliance as their biggest operational challenge — but also a potential competitive advantage.

These figures speak for themselves: fintech companies are at a crossroads where the right strategies can turn obstacles into opportunities.

The Fintech Revolution: Small Innovators, Big Impact

The main trend in the future of fintech is not just about technology — it’s about the way financial services integrate into our everyday lives. Over the past decade, traditional banking and financial technology have changed dramatically, particularly in the areas of payments, lending, wealth management and retail banking.

Tech and e-commerce titans like Google, Amazon, Facebook, Apple, and Alibaba have leveraged their vast reach and cutting-edge technology to dominate the financial landscape. But smaller fintech firms and neobanks are not just holding their ground — they are thriving. Their agility, customer-first innovation, and sharp focus on niche markets have fueled exponential growth, proving that adaptability and tailored solutions can carve out a competitive edge even in arenas ruled by global giants.

At Devox Software, we conducted a comprehensive survey to find out what separates the best fintech innovators from those who can not keep up. The results reveal an important truth: it’s not just about technology or strategy — it’s about culture.

Future of fintech in numbers: between 2025 and 2034, the global market for embedded finance is expected to grow at a CAGR of 23.3%. The rise of embedded finance, sustainable fintechs, and AI-driven wealth management is rewriting the rules for future fintech, proving that even smaller companies can punch well above their weight when driving innovation.

This rapid expansion positions companies at the forefront of innovation as potential leaders in the future fintech stock market. But here’s the kicker: innovation in fintech isn’t just about chasing trends or adopting flashy tech. Our recent Devox Software survey reveals a culture that welcomes change and stays ahead.

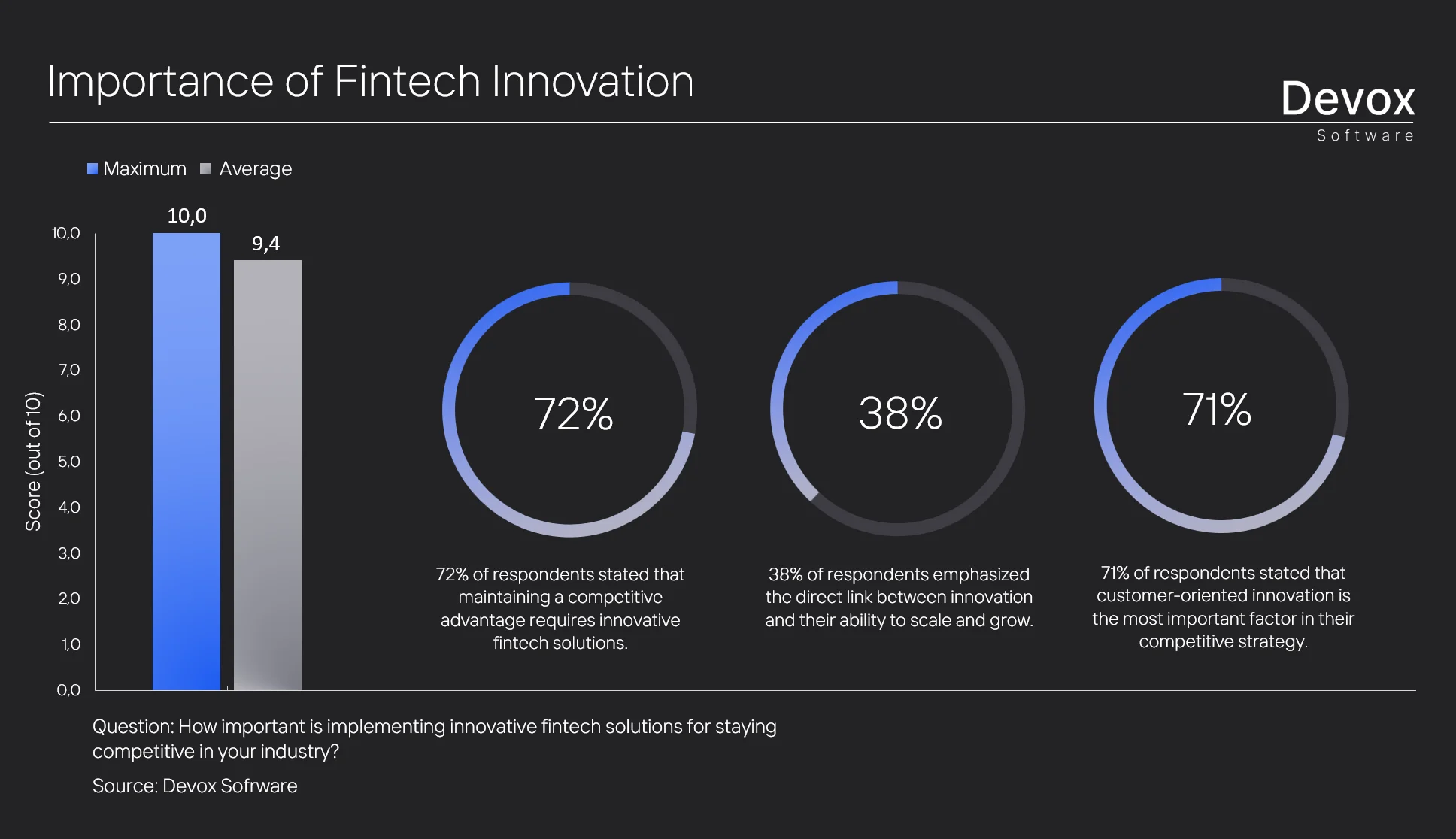

Our study uncovered some hard truths about what separates fintech leaders from laggards:

- 72% of respondents believe companies must adopt AI, RPA, and blockchain to stay competitive.

- Almost 38% emphasized the link between innovation and growth.

- A huge 71% of respondents named customer-centric innovation as their north star.

The standout fintech companies are those that not only react to market changes, but anticipate them. By building innovation, sustainability and a customer-centric mindset into their DNA, these companies are not just riding the wave of fintech disruption — they are shaping its future.

The Blueprint for Fintech Innovation: Built on Culture, Driven by Change

What distinguishes exceptional fintech companies from those that are merely good? Fintech pioneers know that fear — be it of failure, disruption or market volatility — can paralyze innovation. Instead of succumbing to uncertainty, they harness it. These leaders cultivate ecosystems where risk-taking is strategic, and experimentation is celebrated.

But courage and creativity are only part of the equation. The hallmark of fintech excellence lies in agility — the ability to adapt quickly to technological advances, regulatory changes and evolving customer demands. One respondent, Jake, founder/CEO, cited “fundraising” as a key challenge. Another respondent, David, CEO, put it this way:

“Balancing profitable growth and the investments needed to scale the business.”

These perspectives highlight the dual pressures facing fintech leaders — securing funding to drive innovation while maintaining sustainable growth in a highly competitive market. Industry leaders know that agility is a team sport that requires cross-functional collaboration. One of our survey participants, Mark, EVP Solutions, emphasized a critical insight:

“Core team is small and agile. Leverage partners to fill gaps. Know when to partner and integrate vs build.”

Fintech leaders recognize the importance of maintaining a small, agile core team while leveraging outsourcing to fill gaps in expertise or capacity. In addition, outsourcing offers fintechs the flexibility to experiment with innovative solutions without committing to a long-term resource allocation. Whether it’s testing AI-driven credit risk models or trialing DeFi lending platforms, this flexibility allows companies to innovate and scale at the same time.

As highlighted by one of our survey participants, Mike, CTO:

“Innovation is about carving out the time to focus and knowing where and what to explore.”

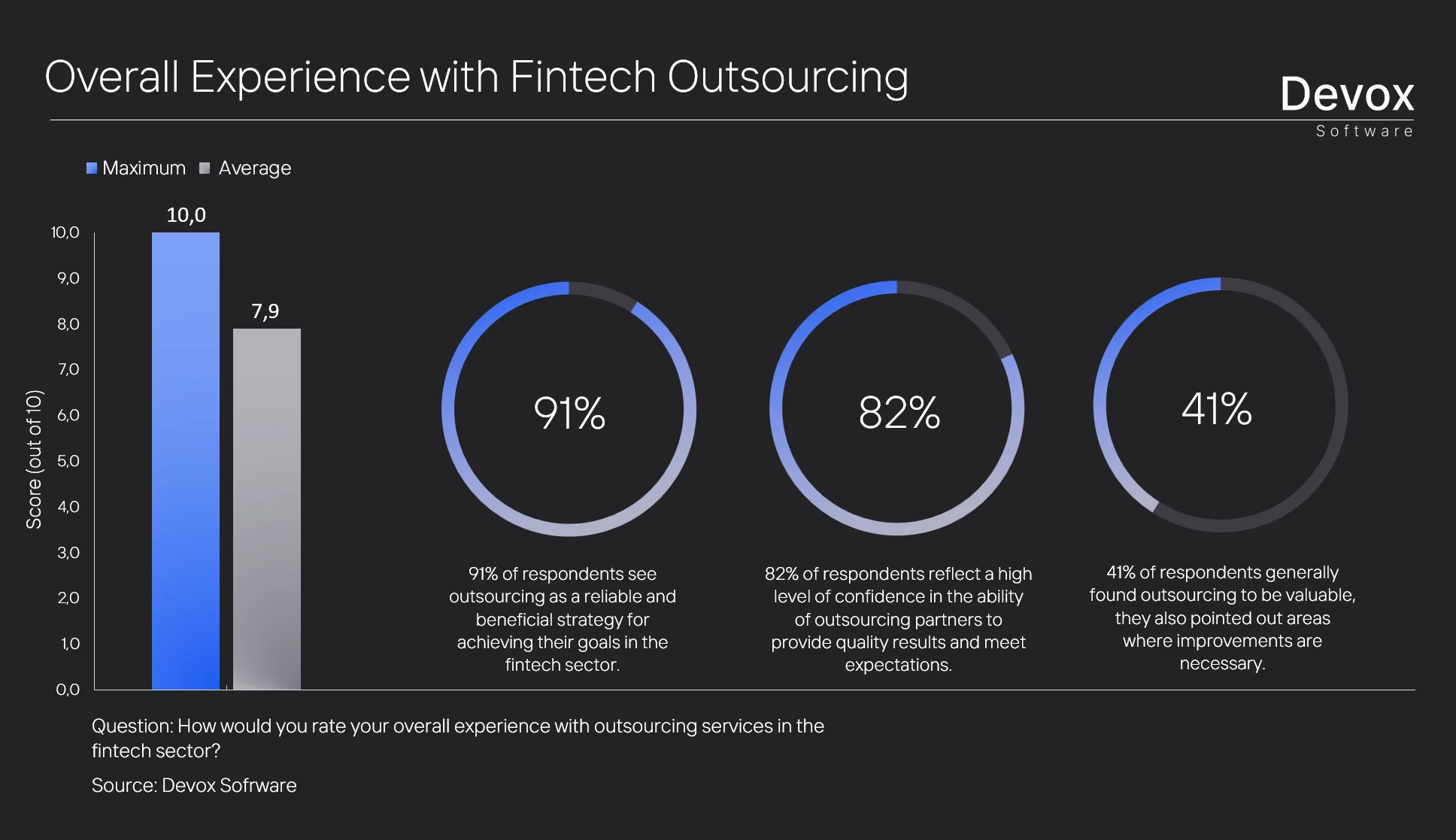

Ultimately, the strength of outsourcing lies in its ability to complement in-house capabilities. The result is a resilient, future-proof business that can thrive in a competitive, technology-driven landscape. Based on the responses to the question “How would you rate your overall experience with outsourcing in the fintech sector?” in our survey, here is a detailed statistical analysis:

- 91% of respondents see outsourcing as a reliable and beneficial strategy for achieving their goals in the fintech sector.

- 82% of respondents reflect a high level of confidence in the ability of outsourcing partners to provide quality results and meet expectations.

- 41% of respondents generally found outsourcing to be valuable, they also pointed out areas where improvements are necessary.

As one of our survey participants, Sree Pamidiparthi, Director, pointed out:

“In terms of software development and outsourcing in fintech, I personally observed that the outcomes are based on how well defined the requirements are.”

This insight underscores the importance of clarity and precision in driving successful collaborations. Fintech companies that prioritize well-structured goals and detailed specifications not only streamline outsourcing processes but also ensure alignment with their strategic vision.

Our exploration of the challenges and opportunities facing the sector has revealed a clear roadmap for success: embrace innovation, prioritize agility, and remain unwaveringly customer-centric. These three pillars form the foundation upon which future leaders in fintech will be built.

The Big Challenges Facing Fintech

Regulatory Compliance: A Hurdle and an Opportunity

Fintech companies are navigating a minefield of regulatory challenges, from AML (Anti-Money Laundering) to KYC (Know Your Customer) requirements. These hurdles demand constant vigilance, adaptability, and significant investment in compliance measures. However, as some industry leaders recognize, these challenges can also serve as opportunities for differentiation.

Companies that are leading the way in RegTech are showing how compliance can be a catalyst for operational efficiency and innovation. They are using AI-driven compliance monitoring and blockchain-based transaction tracking, proving that regulatory requirements can improve fraud detection, streamline operations and build trust.

Our survey at Devox Software revealed important insights into the compliance challenges — and opportunities — faced by fintech companies:

- Balancing security and compliance. 52% of respondents cited maintaining compliance while ensuring product security as their biggest challenge. This highlights the growing tension between meeting regulatory requirements and protecting user trust, particularly in critical areas such as cybersecurity and data privacy.

- Keeping pace with change. 39% of respondents highlighted the difficulty of adapting to rapidly evolving technologies while complying with regulatory requirements.

- Integrating compliance into development. 43% of respondents identified friction between compliance and collaboration in development processes. This shows how difficult it is to reconcile rapid innovation cycles with the complex requirements of the regulatory framework, especially as companies expand their operations.

Top fintech firms see regulatory challenges as chances. Regulatory challenges are not just obstacles but opportunities to build trust and differentiate in the future of fintech. Companies that protect user data will win over cautious customers.

Innovative companies are blending regulatory compliance into their development. They use tools like AI and blockchain to keep up with changes. This helps them maintain a steady pace in their innovation efforts. By addressing compliance requirements, these companies are not only meeting regulations. They are also setting new standards for secure, customer-focused financial services.

After all, the future of financial technology belongs to those who don’t just follow the rules, but redefine them.

Cybersecurity Threats: From Barrier to Catalyst for Innovation

The fintech industry is under siege from cyber threats, with attackers leveraging the same cutting-edge tools as developers. This has made cybersecurity not just a challenge but a critical driver of innovation. Fintech leaders are finding ways to turn these threats into opportunities to enhance security protocols and build trust.

One of our survey participants, Sree Pamidiparthi, Director of fintech company, highlighted pointed out a key issue:

“Main challenge — keeping up the tech debt to minimal changes with the ever evolving technologies, ensuring regulatory compliance and security.”

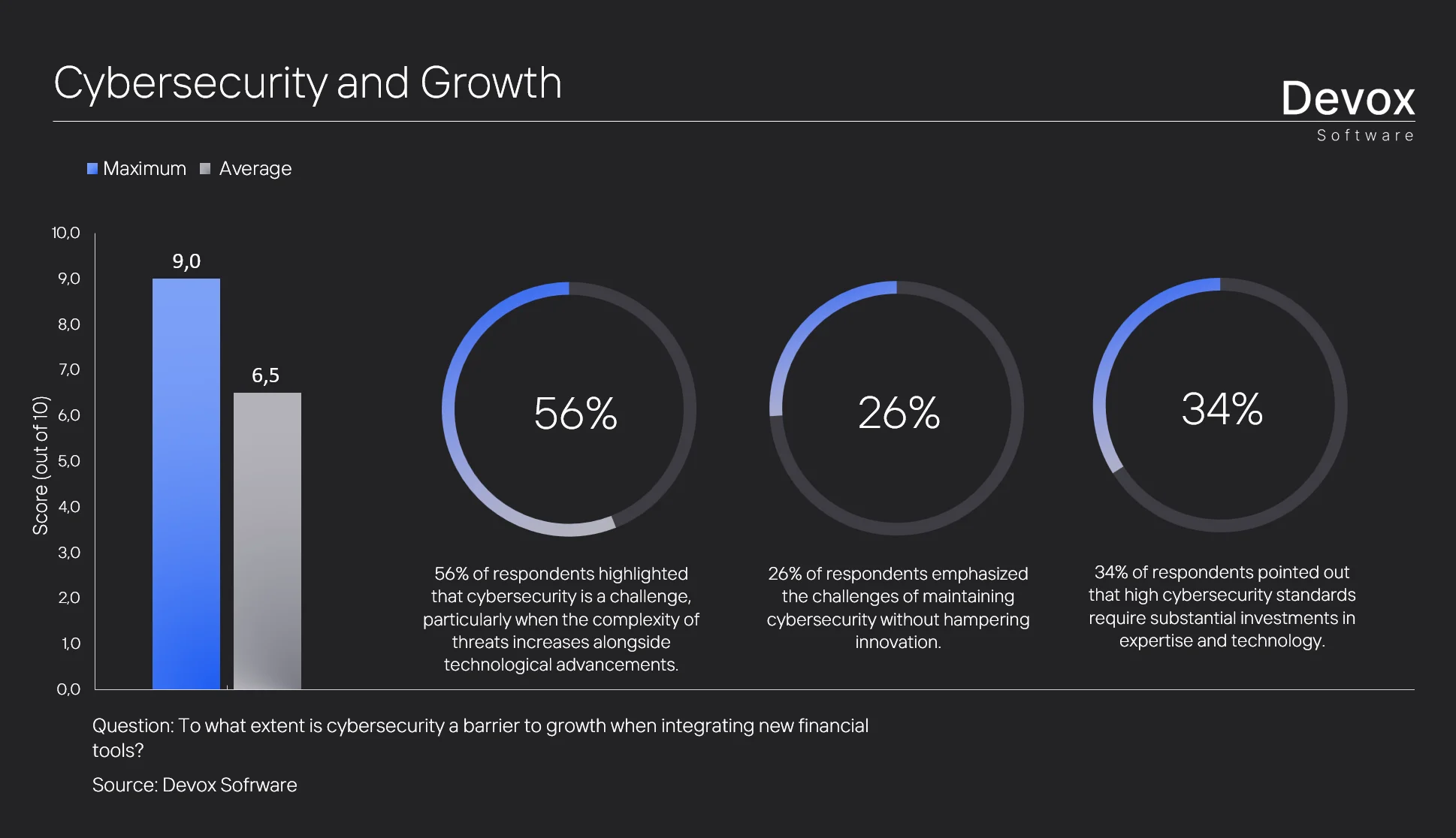

Based on the responses to the question about cybersecurity as a factor in growth when integrating new financial tools, here is a detailed summary:

This data underscores the dual role of cybersecurity in the fintech space: while it poses significant hurdles, it also represents an area where companies can gain a competitive advantage:

- According to our survey, 56% of respondents said that the complexity of cyber threats is one of the biggest challenges they face, especially as new technologies such as blockchain, decentralized finance (DeFi) and robotic process automation (RPA) continue to emerge. These technologies are opening up new attack surfaces and forcing organizations to rethink and strengthen their security protocols.

- However, the balance between innovation and security remains delicate. 26% of respondents emphasized that it is a constant struggle to maintain robust security measures without hindering technological progress. Fintech firms need to bring innovative products to market quickly to remain competitive, but overly rigid security frameworks can delay product development and launch. Companies that successfully navigate this tension are those that incorporate security into their development process from the outset and create solutions that are not only secure but also scalable.

- The financial costs of cyber security also play a major role. 34% of respondents pointed out that maintaining high cybersecurity standards requires significant investment in cutting-edge technologies and expertise.

Jake Peterson, a fintech Tech lead we surveyed shared that:

“The biggest challenge I face time and time again is ensuring that a product is secure, cost-effectively scalable and easy to maintain. Nowadays, we have many more tools at our disposal to develop large, powerful products than in the past. But that same technological advancement also benefits fraudsters, making it harder than ever to develop security solutions that will stand the test of time.

To stay secure, we need to update our product — regularly — and this is where the second challenge comes in: sustainability. Keeping a product maintainable isn’t just about choosing the latest technology, it’s about choosing stable, future-proof solutions that won’t become obsolete overnight. And in a world where new technologies are constantly emerging while older ones are dying out, that’s no small feat.”

The first challenge is a classic balancing act: creating solutions that are secure but don’t crack under the pressure of growth. Modern tools make it easier than ever to scale products, but they also equip scammers with the same level of sophistication. Jake puts it bluntly — future-proofing security systems has never been tougher. Fintech companies can’t afford to fight yesterday’s battles; they have to predict tomorrow’s.

Essentially, it all boils down to strategy. Jake’s findings illustrate one point: fintech leaders need to think beyond the now. It’s not just about choosing the flashiest tool, but asking yourself, “Will this still work when the game changes?”

Because financial technology isn’t just about survival. It’s about outsmarting the storm

Agility in Market Adaptation

In the fintech industry, agility separates the winners from those who fall behind. The best don’t just adapt — they anticipate by keeping pace with technological breakthroughs and changing customer demands. But staying flexible? That’s the hard part. Fintech leaders are in a constant battle to balance speed, innovation and operational efficiency — because in this game, procrastination costs more than money.

Mike, one industry professional in our survey, highlighted key challenges in managing software engineering efforts:

“Overall planning of software engineering efforts – priorities of business, velocity of teams, available resources, growth plans. Being able to measure engineering efforts – e.g. speed, quality, cost, developer happiness.“

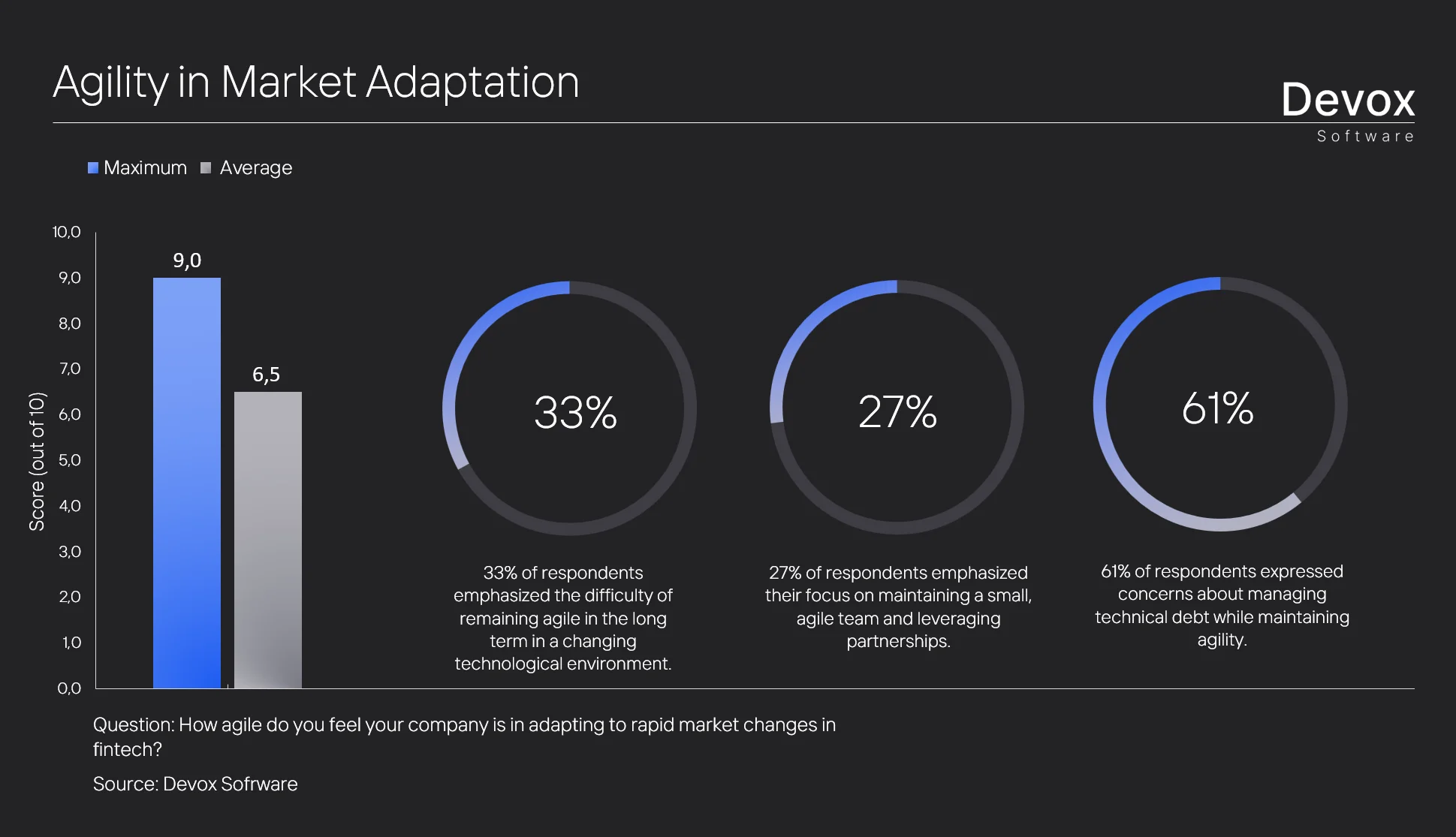

According to our survey,

- 33% of respondents highlighted the challenge of maintaining long-term priorities and strategic planning in an environment where technology evolves at an unprecedented pace.

- 27% of respondents emphasized the importance of keeping a small, agile team and leveraging strategic partnerships to improve adaptability.

- The challenge of managing technical debt was cited by 61% of respondents as the main barrier to agility.

Fintech firms that excel at market adaptation know that agility is not just about speed, but also about intent. By fostering a culture of continuous improvement, optimizing their technical infrastructure and building strong external partnerships, these companies are not just keeping pace with change, they are shaping it.

So agility is more than a survival tactic — it’s a strategic advantage that drives innovation and enables fintechs to lead in an ever-changing market.

Fintech’s Next Leap: What’s Driving the Industry Forward?

Over the past decade, digital payments, lending platforms and blockchain technologies have shaken up traditional models, while tech giants and start-ups alike are vying to redefine customer expectations. But here’s the real differentiator: success in fintech is not just about tech — it’s about mindset.

Today the fintech industry stands at the crossroads of unparalleled innovation and unprecedented complexity. And achieving sustained success requires balancing bold ideas with financial pragmatism.

The companies that lead the way in fintech in 2025 are not those that simply chase trends, but those that turn them into tangible business value. And we at Devox Software are helping to make that transformation happen.

At Devox Software, we are more than just observers of this change — we are partners in progress. With our deep expertise in technology and business strategy, we help fintech companies overcome challenges and capitalize on opportunities.

At Devox Software, we specialize in:

- Financial software development — from robust payment gateways to AI-driven wealth management solutions.

- regTech & compliance — ensuring your fintech product meets PSD2, AML, GDPR and PCI DSS requirements without slowing growth.

- Blockchain & Digital Assets — smart contracts, neobanking and secure digital transactions driving the next wave of financial services.

- cybersecurity & risk management — building fraud-resistant fintechs with dynamic biometrics, AI-driven fraud detection and penetration-tested security.

Scalability and performance — whether you’re a fast-growing fintech startup or an established player, we build solutions that process millions of transactions without breaking down under pressure.

From AI-powered fraud detection to real-time cross-border payments, innovation in payments — the future is fintech. Companies that integrate these advancements will not only enhance user experience but also redefine the global financial landscape.

The future of the fintech industry is being written now. Get in touch!